Luxury Properties Prices in Dubai up 50% to the Strongest Growth Globally

In a new report by Knight Frank’s 2023 Prime Predictions for Real Estate Research, it is expected that new luxury properties in Dubai residential market, including Palm Jumeirah, Emirates Hills and Jumeirah Bay Island, will record next year the strongest price growth in the world as demand is still outweighs supply in spite of the increasing numbers of new luxury houses being built across the emirate.

Dubai new luxury properties prices are likely to end the current year around % 50 higher than 2021 while Dubai’s mainstream residential market is expected to register price increases of % 5-7 by the end of 2022 and a similar rate of growth is expected next year.

The strongest price growth around the world mext year

Faisal Durrani, head of Middle East Research, in Knight Frank’s 2023 Prime Predictions, Dubai Edition report, said a new real estate report that new luxury houses prices in Dubai - including Palm Jumeirah, Emirates Hills and Jumeirah Bay Island - is expected to make the strongest price growth around the world mext year due to the increased demand that is more than the supply .

Faisal Durrani confirmed that Dubai’s luxury residential market has and continues to be a global outlier, with record price growth during the current year.

The hihg values of the luxury new properties are being fueled by Dubai’s safe-haven status, an exceptionally diverse range of international ultra-high-net-worth individuals in search of luxury second homes, and the government’s world-leading response to the pandemic, which has spurred business confidence, he stated.

The Dubai’s appeal is due to its relative affordability

The Dubai city’s appeal is due to its relative affordability with prime homes transacting for around US$800 per square foot, making Dubai one of the most affordable luxury residential markets in the world.

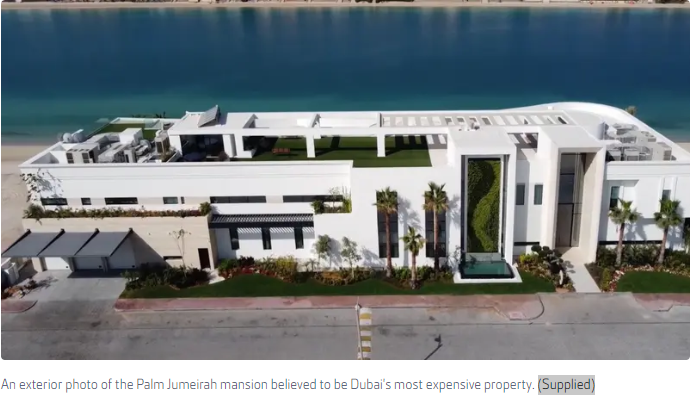

Overall residential prices trail 2014 peak levels by % 21.4 that Dubai’s most expensive luxury house was sold for $76 million (280 million dirhams).

The 33,000 square foot property on the sought-after Palm Jumeirah artificial island features 70 meters of private beachfront and it boasts ten bedrooms, an indoor swimming pool with a spa, Italian marble finishings, and a rooftop terrace overlooking the city’s skyline.

The most expensive luxury property

The luxury sale exceeded the previous record of $50.37 million (185 million dirhams), which was set in 2015 and it was verified by United Arab Emirates real estate data service Property Monitor.

This transaction not only beats Dubai's previous record but closes the gap between Dubai's luxury market and those of leading global cities such as London, New York, and Hong Kong where the highest value property in London is currently on the market for around $40 million; in New York City, $169 million, and in Hong Kong $82.2 million.

The bulk of new high-end homes coming to the city’s prime neighborhoods exist in Bulgari Lighthouse on Jumeirah Bay Island (31 apartments) and Alpago’s Palm Flower on the Palm Jumeirah (11 apartments).

‘Build-it-and-they-will-come’ policy

Faisal Durrani confirmed that Dubai’s perennial challenge has been its ‘build-it-and-they-will-come’ mantra, which has resulted in more homes being built than the market is capable of absorbing but the number of new high-end homes planned is failing to keep pace with demand.

He noted that supply is the other critical factor in the outlook of next year as the developers have not responded to the buoyancy in demand as seen in past cycles and with supply remaining limited and demand for luxury waterfront continuing to strengthen, the 2023 luxury residential forecast of % 13.5 is supported by a clear demand-supply imbalance and a positive economic backdrop.

UAE willbe one of the world’s fastest growing economies

It is expected that the UAE to have one of the world’s fastest growing economies this year with the return to steady and sustainable growth will instill confidence in homeowners and investors alike, he added.

He explained that the outlook is not without its risks as Dubai is a world city and as such is to an extent vulnerable to global macroeconomic conditions and with increasing global economic uncertainty, Dubai is once again emerging as a safe haven destination, just as it did during the height of the corona virus pandemic.

Growth in 2023 higher than that recorded in 6 of the last 10 years

Knight Frank’s global research network now expects new luxury houses prices to rise by % 2 on average in 2023, across the 25 cities tracked, down from % 2.7 predicted six months ago and despite this slowdown, aggregate growth in 2023 would still be higher than that recorded in six of the last ten years.

According to Knight Frank’s analysis, the transition from a sellers to a buyer’s market is already underway across many prime residential markets, but prime residential prices would need to dip by 30-40 percent in some cities for prices to return to their pre-pandemic levels of 2019.

Homeowners are having to grapple with the unpredictability of soaring inflation, the rising cost of debt and higher taxes as well as money is becoming more expensive, geopolitics more complex and China is no longer powering the world’s economy, he concluded.

-1120252475029447.jpg)