Dubai Leads the global luxury home price growth with11% in H1 2023

Savills plc، a global real estate services provider، has released recentle the findings of the latest global luxury home price growth in H1 2023 and found that Dubai، UAE، led the capital value growth performance among the 30 cities tracked by Savills during the period January - June 2023 at 11.2%، following on from the strong performance recorded in H2 2022 as this Emirate is still experiencing high levels of prime residential world cities index growth، helped by favourable economic policies and competitive home prices versus other world cities.

Dubai's property market has demonstrated exceptional performance in the first six months of 2023، with luxury home or residential space gaining 11.2%، despite the economic uncertainties weighing on sentiment globally، according to Savills' prime residential index rankings.

Savills World Research: Dubai has ranked at the top globally for luxury home

Swapnil Pillai، Associate Director، Middle East Research at Savills World Research، announced that the city of Dubai has ranked at the top globally for luxury home and prime residential demand، outpacing its global peers that the forecasts for the second half of this year suggest another round of gains، with expectations of 6-7% growth.

Savills World Research plc، a global real estate services provider، released the findings of the latest global luxury home and prime residential world cities index، which revealed that average capital values during the first half of 2023 in the 30 cities it tracks grew slightly by an average of 1.1% with Dubai at the 4th rank.

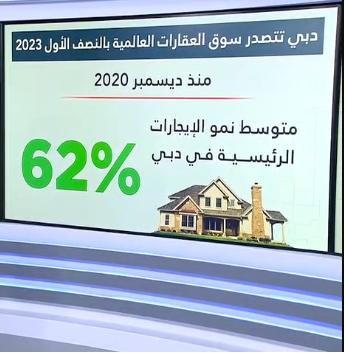

The slowest annual growth since December 2020

In comparison، only 0.8% growth was recorded in the second half of 2022 so that the yearly growth through June 2023 will only be 1.9%، the slowest annual growth since December 2020، meanwhile، average prime residential and luxury home rents grew by 2.6%، outperforming capital values.

Swapnil Pillai، Associate Director، Middle East Research at Savills، indicated that while luxury home and property deals in the West are experiencing a slowdown، Dubai's real estate market remains robust، with 1500 residential property deals finalized at above Dh4000 a square foot، marking a 67% increase compared to the same period in 2022.

The appeal of Dubai's luxury home for its healthy economy

New sales launches are expected in the coming weeks، including Emaar's recent launch of The Oasis، Majid Al Futtaim's Tilal Al Ghaf islands، and Dubai Hills، which continue to attract significant attention as the appeal of Dubai's luxury home and real estate market lies in its growing population، healthy economy with new business opportunities، potential for property value gains، and high rental yields، making it an ideal investment destination for global buyers.

Swapnil Pillai، Associate Director، Middle East Research at Savills، stated that the pace of value increases has stabilized in some locations after significant growth of 25-35% over the past three years and with all these favorable conditions still in place، Dubai remains an attractive and lucrative option for luxury home and real estate investment.

Dubai the 4th on the list of luxury home rental growth

Dubai came in fourth on the list of luxury home rental growth for H1 2023، with gains of 5.4% and since December 2020، average prime rents in Dubai have witnessed a significant increase of 62%، according to Savills World Research.

The city of Dubai has been successful in attracting rich investors from various countries، and this is particularly evident in the growth of branded luxury home residences in the city، a segment especially appealing to an international consumer base. Meanwhile، Lisbon، Singapore، and Berlin led prime residential market rental growth.

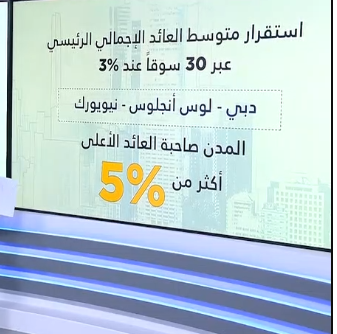

Dubai، Los Angeles، and New York remain the highest yielding cities

The average gross prime yield across the 30 markets held steady at approximately 3% for the first half of the year while Dubai، Los Angeles، and New York remain the highest yielding cities at just below 5%، added Swapnil Pillai، Associate Director، Middle East Research at Savills.

Certain cities are expected to outperform، with Dubai forecast to lead the way with luxury home growth of between 6% and 7.9% while Singapore and Bangkok are expected to follow، with between 4% and 5.9% growth forecasted for H2 2023 as these cities still offer comparative value by global standards.

-1120252475029447.jpg)