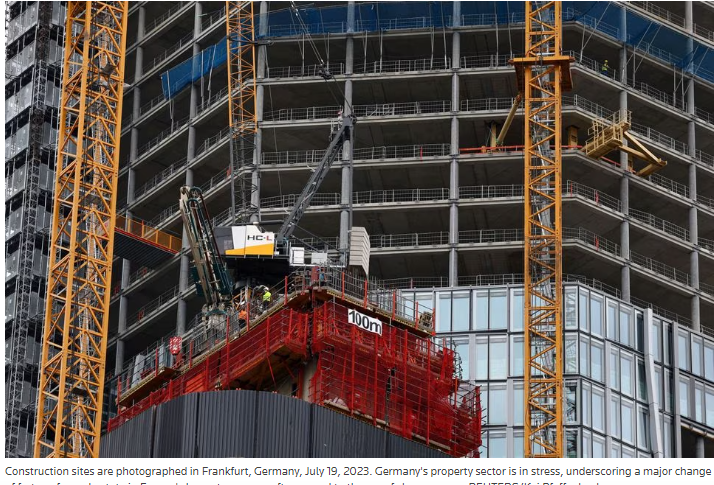

Germany’s real estate sector in stress، new construction plunged 47% in 6months

German Property Federation، GPF، announced today that new construction plunged 47% in Germany during the first half of the year، compared with the average of the past two years and new building permits plunged 27% during the first five months as the property sector، which makes up roughly 20% of economic output and one in ten jobs، is grappling with a major turn of fortune after the largest economy in Europe has long benefited from an era of cheap money that fuelled a decade-long boom in real estate.

Germany's property sector is in stress، underscoring a major change of fortune for real estate in Europe's largest economy after an end to the era of cheap money، according to the German Property Federation (GPF).

Weakness in Germany's real estate has also emerged in the United States، Sweden

Reuters reported that weakness in Germany's real estate has also emerged in many countries such as the United States and Sweden، but Germany is significant because it is Europe's largest economy and the biggest real estate investment market on the continent.

In the latest signs of stress in the sector of Europe's largest economy، Germany's largest real estate group Vonovia posted multi-billion euro losses and writedowns، as well as job growth for construction workers has stagnated، German Property Federation (GPF) added.

The main factors of weakness in Germany's real estate

German Property Federation (GPF) explained that the main factors of weakness in Germany's real estate have been a sudden and rapid rise in interest rates by the European Central Bank as it clamps down on the highest inflation rates in decades، building costs have also soared، and the demand for offices and retail space has waned after the pandemic as well as the Ukraine war has also made German property seem riskier for foreign investors.

Home prices also declined in the first quarter by the most since Germany’s statistics office began keeping data، down 6.8% from a year earlier and in next September، data will show to what extent the trend is continuing and shed light on the state of construction jobs but the current crisis will certainly continue for a while yet، warned Sven Carstensen، chief executive of Bulwiengesa، a property consultant and analysis firm.

Germany aims to build 400 thousand apartments a year

Germany، whose population has recently grown as millions of migrants and refugees from Ukraine flock to the country، aims to build 400 thousand apartments a year but is struggling with its goals، therefore، politicians، ministries and the property industry will convene with Chancellor Olaf Scholz on Sept. 25 to try to find solutions، and some are already jockeying with proposals to rejuvenate Germany's real estate sector.

Last week، Klara Geywitz، Germany’s housing minister، called for additional tax breaks for writing off the costs of construction for new residential buildings but the president of the German Property Federation، Andreas Mattner، is pressing the government to temporarily suspend a property sales tax and is demanding a low-interest rate credit program to support new residential building.

An emergency package of measures

Tim-Oliver Mueller، head of the German Construction Industry Federation، is pushing for an emergency package of measures that would include the cut-price sale of public land for building rentals، especially as Germany’s market for commercial real estate plunged to the lowest level since at least 2017 in the latest sign of the turmoil triggered by soaring interest rates.

Deal volumes in the first half of 2023 declined 50% from the previous six months to €14.9 billion ($16.2 billion)، according to data provided by real estate firm JLL. The figure was about 66% below the average over the past five years and the standstill in Germany mirrors developments across European countries such as Sweden، Ireland and the UK. Commercial property markets have seized as buyers and sellers struggle to agree on pricing.

Rising interest rates have driven up borrowing costs

Rising interest rates have driven up borrowing costs، prompting potential property investors to demand higher yields، resulting in lower offer prices، and owners are resisting granting steep discounts to book values on concerns that could cause debt ratios to surge.

The effects are also visible in the German market for residential real estate as the deals in the segment plunged 69% below the 10-year average in the first half of the year and the real estate industry may even face a decade of limited earnings growth.

-1120252475029447.jpg)