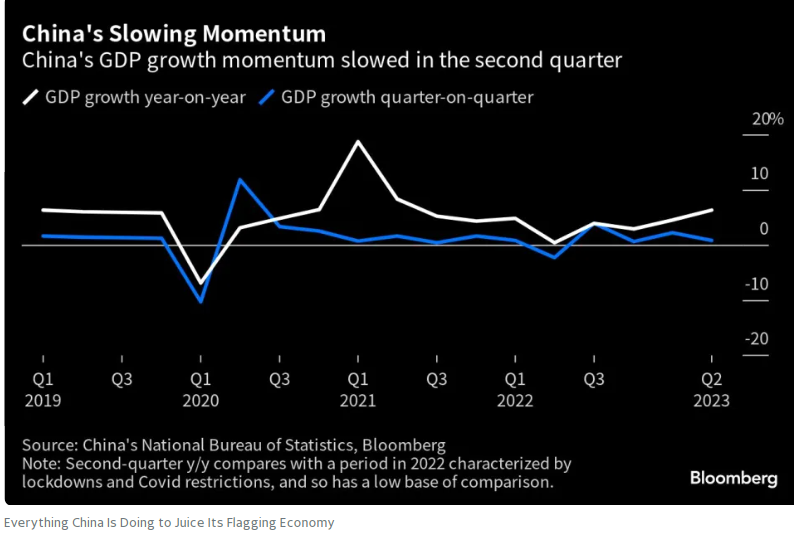

Public debt touched280%of GDP،China to implement measures to revive its slowing economy

China has made a number of pledges recently to revive the economy’s recovery and improve the business environment as concerns about the growth outlook continue to mount and the public debt rate touched about 280% of GDP during the first quarter of this year، to reach a new record level، with banks expanding lending to companies after lifting restrictions imposed to prevent the spread of the Corona virus.

China measures: boosting the stock market، encouraging more spending

China has taken some measures to support its slowing economy after a flurry of statements from the government and Communist Party since July have largely focused on boosting the stock market، encouraging more spending on consumer goods and cars، and coaxing private companies to expand investment.

China is doing everything to juice its flagging economy including top priorities to contain systemic debt risks at government and the Securities Regulatory Commission package of measures aimed at reviving the stock market and boosting investor confidence as China's securities regulator has approved the launch of 37 retail funds to revive stock markets، amid a series of measures to support the market that the new package of policies sends a clear signal to boost investor confidence as the market hits bottom.

Beijing to implement pledges to juice its economy’s recovery

Beijing authorities try hard to implement a number of pledges to juice its economy’s recovery in China including lowering the stamp duty on stock trades by half on Aug. 28، the first cut to the duty since 2008، a move intended to bolster the equities market amid an intensifying selloff، and to slow the pace of initial public offerings and restrict the frequency and size of refinancing for some poorly performing companies.

Government in China has promised to mobilise all resources to reinvigorate its worsening economy after weak economic growth figures in July and the deepening property crisis has further increased the pressure on debt-ridden local governments and increased concerns about the impact on the wider economy.

China top priorities to contain systemic debt risks

China unveiled is implementing measures to revive its economy and improve the business environment and Beijing policymakers reaffirmed that one of their top priorities was to contain systemic debt risks at local government whose focus is on encouraging consumer.

Financial regulators in China pledge further measures to tackle local government debt and property sector woes that is one of the biggest risks facing the economy with the country’s largest private developer Country Garden adding to the sector’s woes.

Bloomberg News reported that Beijing authorities are stepping up moves to prop up slumping markets amid a broad economic slowdown in China، while the Ministry of Finance has vowed to prevent and tackle local government debt risks، by stepping up efforts to control spending.

China’s worsening economic slowdown is rippling across the globe

China’s worsening economic slowdown is rippling across the globe that even with two interest rate cuts this year، Beijing isn’t unleashing the kind of monetary and fiscal stimulus implemented during past downturns.

In a surprise move on Aug. 15، the People’s Bank of China cut its main policy interest rate by the most since 2020، the second reduction this year and the move came shortly before the release of July data that showed weak consumer spending growth، sliding investment and rising unemployment.

Some economists in China were encouraged by the August cut، saying it set the stage for even more fiscal support but in another surprise، Chinese banks later kept a key interest rate that guides mortgages on hold that highlighted the dilemma facing Beijing as it seeks to boost borrowing by cutting rates while trying to preserve financial stability.

Xi Jinping’s government is reluctant to give cash

President Xi Jinping’s government is reluctant to give the kind of cash handouts to consumers that fueled post-pandemic recoveries in the US and elsewhere، while debt-laden local governments in China don’t have the fiscal space for a major boost to spending.

Financial agencies in China told to coordinate support for local governments as they tackle debt risks and Minister of Finance will intensify and implement active fiscal policies، while improving the transfer of financial payments to local governments، in conjunction with reports indicating that the government is seeking to improve macroeconomic policies to support domestic demand growth، while enhancing the security of grain supplies in the country and spreading a campaign to rationalize consumption food.

China bets on better policy enforcement to improve the business environment

China bets on better policy enforcement to save economy and improve the business environment as concerns about the growth outlook continue to mount as its plights have further dampened confidence in China’s already-weak property sector and debt-laden local governments that have borrowed from shadow lenders over the past years.

Beijing authorities try hard to implement a number of pledges recently to revive the economy’s recovery China as the way the local authorities use the public money and the returns generated by the infrastructure projects generated are often opaque and create hidden debt.

Beijing is trying also to address a potential systemic crisis that could trigger a default by allowing local authorities in China to delay repayments and restructure their debts as well as major financial institutions should act proactively and disburse more loans as big state-owned banks continue to act as pillars.

China to coordinate financial support and tools

The financial agencies need to coordinate financial support and tools to support efforts to remove local government debt risks and strengthen risk monitoring، evaluation and prevention mechanisms، and give appropriate guidance to lessen fluctuations in lending and increase the stability of financial support for the real economy in China.

China authorities issued instructions to Banks to increase lending to support the real economy and cut lending costs and credit policy for the property sector will be adjusted and improved، as China’s property crisis has deepened after Country Garden Holdings، the country’s biggest private developer missed several bond payments recently.

GIANT Cos. failed to pay clients after their trust products had matured

Meanwhile the state-backed Zhongrong International Trust، one of China’s biggest players in the country’s shadow banking sector، also failed to pay its clients after their trust products had matured and real estate development giant Evergrande Group incurred a net loss of 33 billion yuan ($4.53 billion) in the 1st half، after losing 66.4 billion yuan in the same period last year.

The Communist Party and government issued in China a rare joint pledge on July 19 to improve conditions for private businesses after wrapping up an almost two-year regulatory crackdown of the technology sector and Beijing outlined 31 measures that included promises to treat private companies the same as state-owned enterprises، consult more with entrepreneurs on drafting policies، and cut market entry barriers for firms as well as the central bank asked lenders and financial markets to provide more support for innovation and tech-related acquisitions، and to boost investment in startups.

-1120252475029447.jpg)