Oil prices soar above $90 as OPEC+ leaders restrict exports to December

OPEC+ leaders Saudi Arabia، the largest oil exporter in the world، and Russia، the second largest oil exporter in the world، announced that they would extend supply curbs for next three months through the end of the year، tightening the global market that the oil prices jump about 2% to reach above $90 per barrel for the international benchmark Brent crude and to $87 per barrel for the U.S. benchmark West Texas Intermediate crude to held near the highest level since last November.

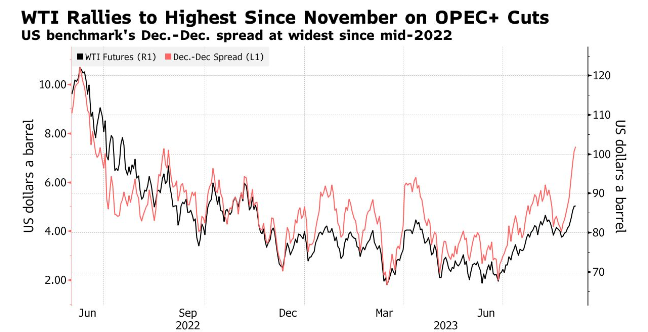

Crude oil touched its highest level since Nov.

Crude oil prices are surging again to their highest level this year as

OPEC+ leaders Saudi Arabia and Russia، the world’s second- and third-largest oil producers jointly agreed to cap output، that the international benchmark Brent crude touched its highest level since Nov. 18، 2022، and the U.S. benchmark West Texas Intermediate its priciest mark since Nov. 15، last year.

The OPEC+ alliance oil-cut extension sets up much tighter finale for 2023 that Brent is up 25% over the last three months and up more than 100% since its 2020 nadir due to the Covid-19 pandemic’s impact on travel، although the U.S. is the largest oil producer in the world، followed by Saudi Arabia، Russia، Canada and China، according to the Energy Information Administration.

Goldman Sachs، UBS: Brent to jump 6% to $95

Goldman Sachs economist Daan Struyven wrote this week his historical analysis which supports the notion the OPEC+ group encompassing Russia، Saudi Arabia and other non-U.S. oil titans will keep lower supply for longer period of time، setting a $93-per-barrel 12-month price target for Brent، implying 4% upside، while Solita Marcelli، chief investment officer Americas for UBS Global Wealth Management، wrote to clients she has a most preferred view on oil globally، projecting Brent to jump 6% to $95 per barrel and WTI to climb 5% to $91 per barrel by year’s end.

OPEC+ leaders Saudi Arabia and Russia to extend supply curbs to end of the year

Forbes Magazine mentioned that OPEC+ leaders Saudi Arabia will cut oil production by a million barrels per day through December، and Russia will reduce output by 300 thousand barrels per day، so that future prices for the commodity subsequently shot up as supply shrank and Brent crude futures for November delivery rose $1.44 to $90.44 per barrel، and US West Texas Intermediate crude futures for October delivery rose $1.85 to $87.4 per barrel، while traders had anticipated the volume of the cuts، the duration was unexpected.

Saudi Arabia voluntary reduction will be reviewed monthly

The OPEC+ leaders Saudi Arabia stated that Riyadh’s decision to extend the voluntary reduction of one million barrels per day will be reviewed monthly to consider increasing the reduction or enhancing production based on market conditions as the Kingdom's voluntary reduction comes in addition to a reduction in production agreed upon by the countries of the OPEC Plus alliance، which includes the Organization of the Petroleum Exporting Countries (OPEC)، Russia and other allies until the end of next year.

The OPEC+ alliance in its last meeting in June، agreed to reduce oil production by an additional 1.4 million barrels per day، to reach 40.46 million barrels per day، while extending the production reduction agreement until the end of 2024، while OPEC members and its allies، including Saudi Arabia and Russia، are scheduled to meet on October 4 of this year.

OPEC+ leaders Saudi Arabia and Russia agree on keeping the oil market tight

It looks like the OPEC+ leaders Saudi Arabia and Russia are on the same page about keeping the oil market tight and oil tests November high After extending supply cuts as the strategy from Riyadh and Moscow will help to drain inventories further، while driving the market’s underlying time spreads further into backwardation، a bullish pricing pattern that the gap between WTI’s two nearest December contracts has surged to the widest since mid-2022.

The OPEC+ alliance leaders Saudi Arabia and Russia are causing the oil to rally sharply this quarter after the Organization of Petroleum Exporting Countries and its allies adopted group-wide supply cuts that were then supplemented by additional، voluntary reductions and the production restraints have been implemented just as the International Energy Agency estimates that global crude consumption is running at a record pace.

Oil prices surge risks stoking a fresh wave of inflation

The OPEC+ alliance warns that oil prices surge risks stoking a fresh wave of inflation around the globe as it lifts prices، including for fuels such as gasoline and diesel، and further constraints on oil supply should see oil prices remain well-supported that could complicate the task facing central bankers just as they try to decide whether they’ve already raised interest rates high enough to restrain the pace of price gains.

Oil prices remain down considerably from their multiyear peaks reached last year after Russia moved into Ukraine، upending global oil markets after a U.S.-led coalition announced they intended to stop Russian oil imports and gas prices rise noticeably as crude oil prices soar، a strong likelihood considering crude prices largely determine the price American drivers pay at the pump. U.S. gas prices climbed over $5 per gallon for the first time ever last year.

-1120252475029447.jpg)