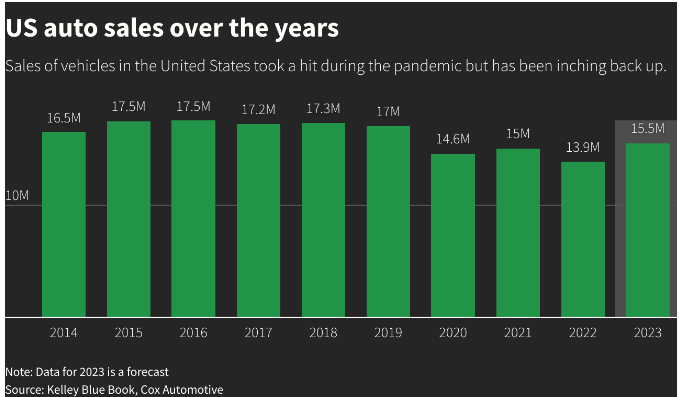

American automakers to have sold15.5million cars، the highest year since corona virus

The Consultant Cox Automotive Agency reported that American automakers in Detroit، Michigan، are expected to have sold a total of about 15.5 million cars in the U.S. last year، the highest since 2019 before corona virus، with General Motors edged past rival Japanese Toyota Motor to remain the top selling automaker in the U.S. in 2023 as easing supply snags and sustained demand drive the industry to its best year since the corona virus pandemic.

American automakers in Detroit expects the robust demand to carry over into 2024

The Consultant Cox Automotive Agency stated that American automakers in Detroit expects the robust demand to carry over into 2024 leading by General Motors and forecast total industry sales of 16 million units for the new year after U.S. sales last year surpassed sales of nearly 13.9 million in 2022.

The Consultant Cox Automotive Agency The Consultant Cox Automotive Agency revealed that American automakers leading by the Detroit automaker General Motors shrugged off a hit from a costly auto strike to report U.S. new vehicle sales of about 2.6 million units for 2023، up 14.1% from last year، while Toyota's annual sales rose 6.6% to about 2.25 million vehicles to becomr the top-selling automaker in the U.S.

American automakers leading by General Motors with Chevrolet and Cadillac

The Consultant Cox Automotive Agency assured that American automakers leading by the Detroit automaker General Motors with its new models such as Chevrolet and Cadillac all-electric 2025 Escalade IQ luxury SUV will witness increasing sales in this year.

The Consultant Cox Automotive Agency explained that the resurgence in U.S. sales comes after companies ramped up production to keep up with sustained demand for new vehicles in 2023، though some analysts have warned that high interest rates will take a toll on demand this year، however، high vehicle prices and high interest rates remain the industry's Grinch right now، and that trend will continue into next year.

Car dealers offer generous incentives and discounts to clear older inventory

In a sign of easing demand، car dealers had to offer generous incentives and discounts in December to clear older inventory after two years of holding back on promotions and this is the third consecutive year in which U.S. consumers spent more than half a trillion dollars buying new vehicles، as well as electric vehicles also grabbed a bigger share of consumer spending in 2023، acoording to he Consultant Cox Automotive Agency.

Toyota sales of electrified vehicles، which include hybrid vehicles and all electric models، rose 30.4% to more than 657.3 thousand vehicles، making up 29.2% of its overall U.S. sales، while GM sold about 75.9 thousand EVs، of which 62 thousand cars were Bolts and nearly 14 thousand green cars were Ultium platform EVs as the American company offered $7،500 incentives on its electric cars that lost a U.S. government tax credit last week.

Cox Automotive Agency confirmed total U.S. EV sales 8% of overall auto sales

The Consultant Cox Automotive Agency confirmed that total U.S. EV sales are about 8% of overall auto sales in 2023، with that number rising to around 10% this year، and sales of green cars are likely to continue to improve، just not at the astronomical rate the industry saw in years past report.

Sales of new vehicles in the U.S. are expected to increase slightly this year، as the automotive industry continues to normalize from the coronavirus pandemic and other supply chain problems since 2020 and forecasts from leading automotive data firms are calling for a year-over-year increase of between 1% and 4% to roughly 15.6 million to 16.1 million vehicles sold to be the highest since 2019، when more than 17 million new cars and trucks were sold domestically،the Consultant Cox Automotive Agency said.

Auto industry battling production and supply chain problems sparked by Covid crisis

The Consultant Cox Automotive Agency indicated that since that time، the auto industry has been battling production and supply chain problems sparked by the global Covid health crisis، with sales of less than 14 million vehicles in 2022، the lowest in more than a decade but even a small increase in U.S. sales could be good for consumers and the economy as it would mean more vehicles are being produced، potentially easing recent affordability concerns amid inflation، high interest rates and record high new vehicle prices.

The Cox Automotive Agency believes new vehicle pricing power for automakers has peaked، as improved inventory has driven incentives back into the market، while this year holds the promise of further increased inventory and enticing deals that consumers have eagerly awaited، but 2023′s high interest rates are expected to linger، provoking conflicting market dynamics، however، pricing power gives way to incentives.

Increased sales are good، but lower prices and rising incentives are expected to be headwinds

For investors، increased sales are good، but lower prices and rising incentives are expected to be headwinds for many automakers and dealers that have produced record profits in recent years، while Automakers specifically will weigh one other key consideration in 2024: Are they satisfied with this newly established supply-demand equilibrium، or are they willing and able to push sales volumes closer to prepandemic norms?

The new year is expected to be another year of cagey recovery، with the auto industry moving beyond clear supply-side risks، into a murkier macro-led demand environment and any increase in U.S. sales this year would mark the first sequential sales growth for the automotive industry since 2015-16 and it is expectd that sales to reach between 15.7 and 15.9 million units in 2024، an estimated increase of roughly 2% from sales of 15.5 million units in 2023 but GlobalData، which acquired LMC Automotive، is forecasting a nearly 4% increase in U.S. new vehicle sales to 16.1 million units this year.

Cox Automotive’s chief economist expected at the low end، 15.6 million vehicle sales

Jonathan Smoke Cox Automotive’s chief economist expected at the low end، 15.6 million vehicle sales، driven largely by an increase in fleet or commercial sales، while retail sales are expected to be mostly flat as they expectrd sales growth to be constrained and weak in 2024، a bit more normal compared to the chaos of the past three years after Covid19.

Sales of new vehicles in the U.S. are expected to increase slightly next year، as the industry normalizes from the coronavirus pandemic and other supply chain problems since 2020 and forecasters expect auto sales this year to increase by between 1% and 4% to roughly 15.6 million to 16.1 million vehicles sold.

-1120252475029447.jpg)