European Central Bank warns lenders of commercial real estate woes، poor risk management

European Central Bank، ECB، warns، in a dialog with lenders that comes before the annual bar for their financial strength is set، banks in Europe of Consequences for poor property risk management، as they may face higher capital requirements if they have an insufficient handle on risks they face this year from commercial real estate woes، as contagion spreading to European banks as values plunge، while individual requirements would probably only apply next year.

European Central Bank، ECB، concentrates on the management of commercial property risks

European Central Bank، ECB، is placing greater emphasis on the management of commercial property risks، and addressing banks’ shortcomings in credit risk management as one of its top priorities and commercial real estate is a key focus for ECB supervisors، said the people، who asked to remain anonymous as the discussions are private.

American Bloomberg News Agency reported that commercial real estate markets have been in a sharp decline as last year’s spike in interest rates compounded challenges from the shift to work from home and changing retail behavior.

ECB scrutinized banks’ lending practices for several years

European Central Bank، ECB، the watchdog has scrutinized banks’ lending practices for several years and has repeatedly faulted them for taking too much risk، including in December when it cited evidence that lenders were over valuing collateral.

European Central Bank، ECB، latest escalation follows pressure from the the watchdog last year that the people familiar with the matter say contributed to banks booking higher provisions for possible losses on commercial real estate.

European Central Bank’s senior officials say that while the ECB’s intensity hasn’t changed، the materialization of losses means the watchdog’s approach is evolving.

Real estate distress is causing shockwaves at banks

Real estate distress is causing shockwaves at select lenders، from NYCB in the Americas to Aozora in Asia and Julius Baer and Deutsche Pfandbriefbank in EMEA، confirmed the European Central Bank، ECB، but the rot doesn’t look global or systemic.

European Central Bank، ECB، explained that it is thin comfort with office landlord bonds no longer riding high as sector fundamentals may offer limited reassurance، though not especially concerning but provisioning could rise، dampening profit and denting capital.

The officials in the European Central Bank، ECB، Bloomberg spoke to، stated that they don’t expect the troubles in the commercial real estate market to result in a significant hit to banks’ capital ratios، but they view the pressure on banks’ risk management as a way to limit the damage.

ECB wants to ensure banks are doing look through credit analysis

European Central Bank، ECB، wants to ensure that banks are doing look through credit analysis، especially given the change in interest rates، and banks have been slow to re-assess real estate loans as being riskier، Elizabeth McCaul، a member of the ECB’s Supervisory Board، indicated last month at a conference in Frankfurt.

European Central Bank، ECB، revealed that investors have been focused on the risks banks face from US commercial real estate، which has seen some of the steepest declines in valuations as in the US، the KBW Regional Banking Index has slumped more than 10% since New York Community Bancorp last week announced a surprise loss tied to deteriorating credit quality، spooking investors in other banks including Valley National Bancorp.

German Deutsche Pfandbriefbank AG saw its bonds and shares hammered this week

European Central Bank، ECB، announced that in Germany، Deutsche Pfandbriefbank AG saw its bonds and shares hammered this week over concerns about its exposure to the US commercial real estate، in a sign that the troubles are spreading to Europe، as the ECB slapped Pfandbriefbank with the single highest increase in its capital requirements for individual banks last year، however، the firm didn’t explain why، yet said in December that it’s well above what’s required of it.

European Central Bank concluded that European banks on aggregate، already face a higher bar for their financial strength this year، and that’s largely because national regulators have ordered them to build buffers to weather an economic downturn، a requirement set by the ECB that feeds into the minimum level rose only slightly overall، albeit with jumps for certain lenders.

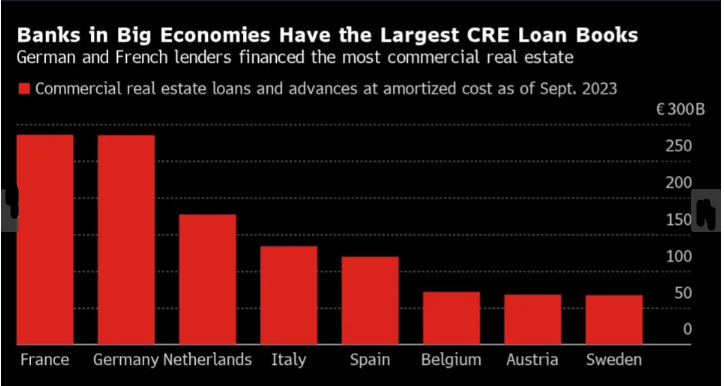

The most commercial real estate loans in French and German banks

French and German banks have the most commercial real estate loans in the European Union، according to data from the European Banking Authority for the third quarter and earlier analysis from the European Systemic Risk Board، a fellow watchdog، shows banks in Germany have the highest share of cross border commercial real estate exposure among banks from the bloc’s major economies.

European Central Bank، ECB، the watchdog، added that Germany and Austria are also the epicenter of the euro area’s most prominent commercial real estate blow up so far، the collapse of tycoon Rene Benko’s Signa group of companies، while، the ECB has been criticized by some bankers for what they say is a hand in the demise of Signa، but the ECB has pushed back against that characterization، with its former top supervisory official calling it is bizarre given it is the central bank’s job to ensure lenders deal with risks.

-1120252475029447.jpg)