Sea Intelligence expects 70%carbon emissions increase for ships diverted from Suez Canal

Sea Intelligence، the Danish leading provider of Research & Analysis، Data Services، and Advisory Services within the global supply chain industry، with a strong focus on container shipping، estimates that carbon emissions for a modern large container ship for a round trip would rise by over 70 % with a 1% speed increase typically produces a 2.2 % rise in fuel consumption، when diverted from Suez Canal، Red Sea، to the longer route around the Cape of Good Hope.

Sea Intelligence co.، which supports customers across all stakeholder groups، and combines strong quantitative analytical skills with a deep understanding of the supply chain industry، based on many decades of experience at all central parts of the Ocean supply chain، said that operators of large container ships ditch slow steaming to compensate for longer journey around the Cape of Good Hope.

Shipping companies try to minimise the extra sailing time

Sea Intelligence co. revealed that for ships that would normally use the Suez Canal Ships diverted from Red Sea pump out more emissions in bid to speed up the longer journey around the Cape of Good Hope، while these ships pump out more carbon emissions، according to British Financial Times Neswpaper.

Sea Intelligence co. assured that carbon emissions from container ships، oil and car carriers as well as dry bulk ships diverting from the Red Sea are set to increase as much as 70 % as vessel operators increase speeds to compensate for the longer route around the Cape of Good Hope.

Leading container ship operators increased vessel speeds

Sea Intelligence co. stated that leading container ship operators including Denmark’s AP Møller-Maersk، and Hapag-Lloyd are among companies which have increased vessel speeds in an attempt to minimise the extra sailing time for ships that would normally use the Suez Canal.

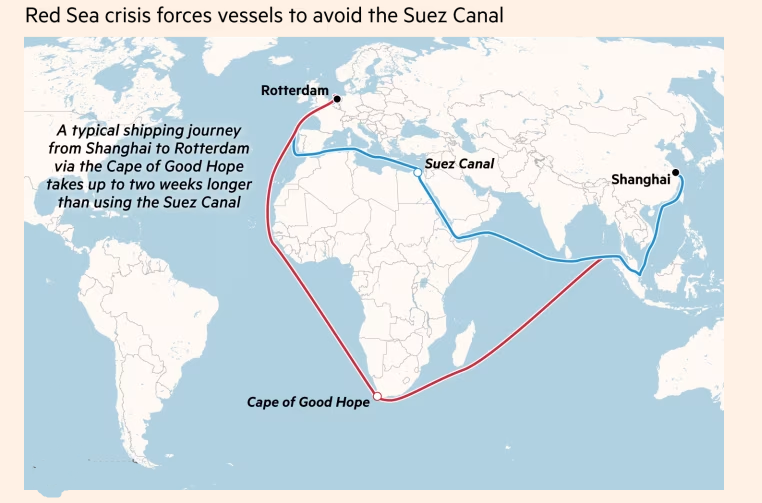

Sea Intelligence co. explained that the increased carbon emissions are a result of vessels being rerouted because of the attacks by Yemen’s Houthis on commercial ships in the Red Sea and Gulf of Aden، as most shipping companies have been taking the longer route since November، which at normal speeds adds between 10 - 14 days to a container ship’s voyage from Asia to Europe، however، the speed increases follow nearly a decade of slow steaming by most shipping companies in a bid to economise on fuel use and minimise their carbon emissions.

Maersk suspended slow steaming on some services

Sea Intelligence confirmed that Maersk، operator of the world’s second-biggest container ship fleet، announced it had suspended slow steaming on some services to catch up on some of the delay from sailing around the Cape of Good Hope and Hapag-Lloyd، the fifth-biggest container line، said also that speeds had generally increased and that it was accelerating ships when necessary to overcome congestion delays.

Shipping analysts at Sea Intelligence said that shipping line customers were caught between a rock and a hard place by the operators’ decisions to increase vessel speeds as if they want to move their cargo، they will have to accept a significant increase in their carbon emissions.

Container ships operate at 14 knots

Container ships in recent years had been operating at 14 knots، the equivalent of about 16 miles per hour on land، accordind to Simon Heaney، senior manager in container research at London-based Drewry Shipping Consultants، who anticipated most shipping lines would follow a hybrid approach، increasing speeds only to 15 or 16 knots، added shipping analysts at Sea Intelligence.

Car carrier operators، which move completed vehicles، mainly from Japan، Korea and China to Europe and the United States، were struggling to cope with a big increase in demand even before the diversions as few new vessels are due for delivery this year، according to Lasse Kristoffersen، chief executive of Wallenius Wilhelmsen، operator of the largest fleet of car-carrying ships، who said that his company’s vessels had also sped up.

The vessel speeds couldnot make up for the added transit time

The vessel speeds were nothing near to the speeds that could make up for the added transit time، European emissions trading regulations were a limiting factor to the speeds and shipping companies that operate into and out of EU ports were included in the emissions trading scheme، which forces emitters to buy permits for excess emissions since the start of this year.

Shipping analysts at Sea Intelligence concluded that the speed increases for the companies diverted from Red Sea to the longer route around the Cape of Good Hope extend to companies moving dry bulk commodities such as coal، iron ore and grain whose ships in recent years have sailed at average speeds as low as 10 or 11 knots، while daily charter rates for dry bulk ships about 50 % higher than a year ago، and the vessels are running a bit faster than before the recent disruption as well as it is expected increased pressure for higher speeds going forward but cause an enormous environmental cost.

Continuing fears of Houthi attacks on ships in the Red Sea

There are more ships loaded with grains that have turned away from the Suez Canal to take the Cape of Good Hope route، with continued fears of attacks on ships in the Red Sea، which usually passes through about 7 million tons of grains per month، but other types of shipping have decreased significantly as the Houthis continue their attacks on Ships despite US led air strikes on Houthi positions in Yemen، according to a report by the Danish company Sea Intelligence.

Analysts at the Danish company Sea Intelligence added that there are still huge containers and tankers carrying American and European shipments، avoiding the Red Sea، and not a single ship in the Atlantic Ocean carrying grains to Asia is heading towards the Suez Canal، while the shipments coming across the Atlantic include large exports of American grains to countries in Asia and the Middle East، but many shipments coming from the Black Sea، most of which are exports from Russia and Romania، continue to travel via the Suez and Red Sea، although only 3 ships out of dozens of sailing ships changed their course and took the longer route around Africa.

Carbon emissions and the high cost of war risk insurance due to Houthi attacks

Carbon emissions were not the only risks resulting from the attacks launched by the Houthis since last November on the trade movement between Asia and Europe، and raised concerns among global shipping companies، as insurance companies raised the cost of insurance against war risks on American، British، and Israeli ships crossing the Red Sea by up to 50%.

While some insurance services companies also avoided covering such ships due to the Houthi group targeting their ships heading to the Middle East، which prompted many companies to change the course of the ships to circle around South Africa.

US is leading Operation Prosperity Guardian in the Red Sea

The United States is leading Operation Prosperity Guardian through missile attacks on Houthi positions in Yemen to protect commercial ships that are being attacked in the Red Sea، with calls from organizations and federations of merchants and associations in Canada، Bangladesh، Brazil، Portugal، Africa، India، Taiwan، and Poland، whose members depend on safe maritime shipping routes.

The multinational security initiative includes at least 23 countries so far through the multinational maritime military coalition that was established last December 18 as an initiative launched by the United States، to join، support، or agree with the mission of supporting safe maritime trade in the Red Sea with the aim of confronting Houthi attacks targeting commercial ships sailing to and from Israel via the Red Sea.

-1120252475029447.jpg)