$200 tax on green cars to cover gas tax as billions of dollars at stake

Alberta this past spring slipped green cars owners a bill for $200 tax، due every year on top of the standard registration fees، to account for the wear and tear on roads their cars cause and in doing so، it joined Saskatchewan and a number of jurisdictions in the United States that have imposed additional fees on EV drivers to compensate for the fact that they’re not paying taxes on gasoline.

Alberta also said it’s because green cars are heavier on average، so they cause more wear and tear on roads and the $200 annual fee is meant to offset the estimated fuel tax that EV drivers would have paid if they were filling up at the pump of gasoline.

Such policies against green cars are generating a lot of discussion

Such policies against green cars in Alberta and other states are generating a lot of discussion and raise a question for politicians: As more EVs roll away from dealerships، how will governments replace the revenue they once raised by taxing gasoline?

There are a lot of taxes on gasoline: there’s the 10 cent per litre federal excise tax (4 cents for diesel)، the 5 % goods and services tax، the provincial harmonized sales tax، provincial fuel taxes، plus federal and provincial carbon levies، while there is not any taxes on green cars.

It’s not clear exactly how much money is raised from all those taxes

Department of Finance official stated that it’s not clear exactly how much money is raised from all those taxes، but there are some estimates. For example، the federal excise tax raised about $4 billion in each of the past two years.

But that still doesn’t solve the question of how to make up for the impact on gas revenues as green cars increasingly make up a larger portion of the country’s overall fleet as at the moment، EVs account for a small portion of the cars cruising Canadian roads، just one of eight، or 12.5 %، of all new cars registered in Canada in the first three months of 2024 were EVs.

Federal government wants 100 % of all new vehicles to be zero-emission vehicles by 2035

But the federal government wants 100 % of all new vehicles to be zero-emission vehicles by 2035، which means policymakers better get cracking on a solution on how to replace the revenue from taxing gasoline.

Canadians have been standing at filling stations for decades، so they’re probably not thinking too much about the taxes they pay on their gas or where that money goes، but that may change as more green cars and electric vehicles are sold.

Consumers have paid $2 billion on average per year in federal tax on gasoline and other fuels

Statistics Canada data shows that consumers have paid $2 billion on average per year between 2018 and 2022 in federal tax on gasoline and other fuels، as well as on some lubricants for tools and equipment for recreational vehicles and the provinces raised $2.4 billion on average per year during those years، but that does not include what businesses pay in taxes on gas and other fuels.

Not all the money raised from taxing gasoline is spent on road maintenance and construction، as at the federal level and in many provinces، regardless of where taxes are collected، the taxes are deposited into a consolidated revenue fund to help pay for a range of programs، from health care to education to roads.

Revenue from gas taxes isn’t all put into road repairs

Devin Arthur، director of government relations at the Electric Vehicle Society، a national consumer advocacy group، say that you kind of have to look at the bigger picture as the reality is that the revenue from gas taxes isn’t all put into road repairs so that it is not logic to impose tax on green cars.

There are exceptions as Ontario earmarks two cents from its nine-cent flat tax to its Dedicated Gas Tax Fund for Public Transportation program and it is projected to distribute nearly $380 million this year to more than 100 municipalities.

A total of $14.6 billion on average on road construction are spent each year

Regardless، the federal، provincial and municipal governments، plus businesses spent a total of $14.6 billion on average on road construction each year between 2018 and 2022، according to Statistics Canada’s most recent data and that includes building new roads and resurfacing old ones، but it doesn’t include repairs such as filling potholes، so the actual dollar amount is even larger.

Some green cars owners say it’s unfair to charge them extra fees as the average weight of vehicles has been increasing for years and heavy gas-powered auto owners aren’t being charged extra fees، while a Tesla Model 3، for example، weighs 1766 kg to 1857 kg، whereas a Ford F-150 weighs between 1834 kg and 2617 kg.

Tax on green cars is set arbitrarily

In some cases، it may come down to the weight of the driver and passengers on board، but so far، no one is calling for people to pay extra fees based on their personal size and green cars should، of course، pay their fair share because they are using the roads، Arthur said، noting that one of the big concerns from EV drivers is that the price they’re paying is set arbitrarily.

For example، he asked if it would be fair for the owner of a GMC Hummer green car to pay the same fee as the owner of a Nissan Leaf electric car even though the former weighs far more and similarly، an EV owner who drives less than the average amount each year may not deserve to pay the same as other drivers who are on the road more.

Internal combustion engine cars pay taxes in proportion to how much gas they use

Drivers of internal combustion engine cars pay taxes in proportion to how much gas they use، not necessarily the distance they drive، which varies based on fuel efficiency، while، electric، green and internal combustion engine vehicles differ in many ways، including how they are used.

In the U.S.، Utah has started a voluntary program for electric- and hybrid-vehicle owners to pay a flat 1.06 cents U.S. per mile driven، with a cap on fees depending on the vehicle type and some policy analysts have suggested that a system that charges drivers based on how much they drive could also be implemented in Canada.

Putting a tax on green cars may not work

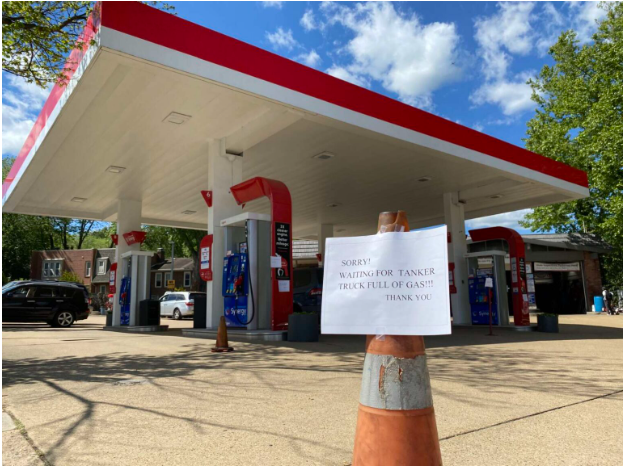

So far، the government has raised money by charging taxes at filling stations، but simply putting a tax on green cars and electric cars may not work because not all electricity is used to recharge vehicle batteries، and not all EV drivers use public charging stations، although raising taxes on electricity to replace declining gas taxes may be possible، it might not be politically feasible.

Luc Godbout and Michaël Robert-Angers at the Université de Sherbrooke wrote in a paper earlier this year that raising taxes is generally not a way for our political decision-makers to become popular and fuel taxes have been declining relative to the size of the economy since 1981، while the federal excise tax on fuel could be automatically indexed on an annual basis to inflation to stabilize this revenue stream.

Luc Godbout and Michaël Robert-Angers revealed that road maintenance and development is a major expense for provinces and it is desirable that specific taxes be levied in line with the user-pay principle.

-1120252475029447.jpg)