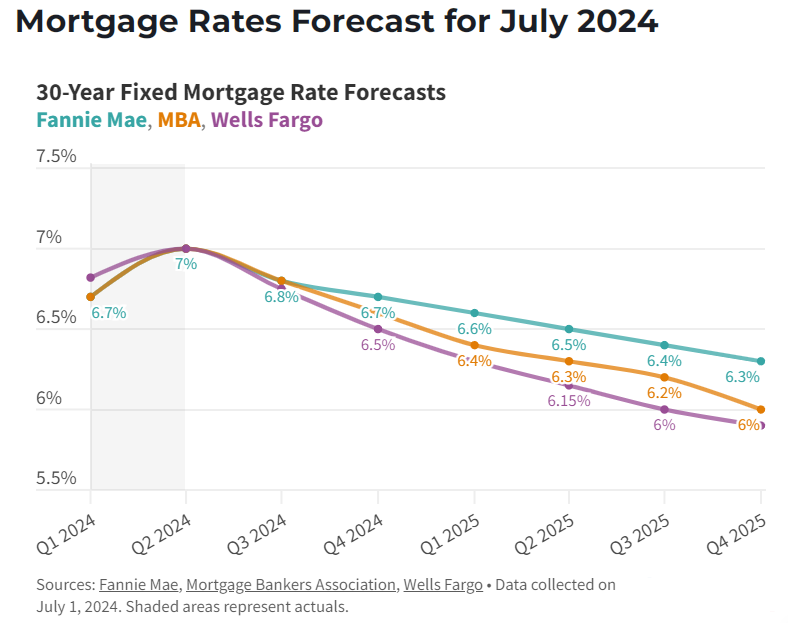

American mortgage rates to decline from 7%now to 6% by next year

American mortgage rates dropped for the fifth time in six weeks as Fed Rate -Cut expectations mount and homebuyers are starting to see slight signs of relief and ortgage rates in US have eased in recent weeks from more than 7%، where it hovered in April and May to less than 6.9% and it is expected to decline to 6% by the end of next year.

American mortgage rates are expected to decline later this year as the US economy weakens، inflation cools and the Federal Reserve cuts interest rates، but until the Fed sees evidence of slowing economic growth، interest rates will stay higher for longer.

American mortgage rates dropped for the 30-year fixed mortgage rate

American mortgage rates dropped for the 30-year fixed mortgage rate is expected to fall to the mid-6% range through the end of 2024، potentially dipping into high-5% territory by the end of 2025 and that will impact the housing US market as a whole.

American mortgage rates in the US dropped for the fifth time in six weeks as the average for a 30-year، fixed loan was 6.89%، down from 6.95% last week، Freddie Mac said in a statement today،Thursday.

American mortgage rates are expected to decrease

American mortgage rates are expected to decline when the Federal Open Market Committee cuts the benchmark interest rate، which is likely to happen later in the second half of this year when cooling inflation and a slowing job market could strengthen the Fed's position and put some much-needed relief on interest rates.

However، unexpectedly hot economic data would change the baseline projection for American mortgage rates، keeping them elevated at their current levels and it will not be appropriate to reduce the target range for the federal funds rate until the Fed has gained greater confidence that inflation is moving sustainably toward 2%.

The data have not given the Fed that greater confidence

So far this year، the data have not given the Fed that greater confidence،" says Fed Chair Jerome Powell at the June FOMC press conference، while the most recent inflation readings have been more favorable than earlier in the year، however، and there has been modest further progress toward its inflation objective، but it will need to see more good data to bolster its confidence that inflation is moving sustainably toward 2%.

Most economists agree that the FOMC will cut rates later in 2024، which will pull American mortgage rates back gradually to the mid-6% range by year-end as the June Housing Forecast from Fannie Mae puts the average 30-year fixed rate at 6.7% by year-end and this reflects a downward revision in Fannie's analysis: One month prior، the mortgage giant expected rates would stay at or above 7% for the remainder of the year and Fannie Mae predicts mortgage rates will average 6.8% in 2024 and 6.5% next year.

The US economy appears to be slowing

The US economy appears to be slowing، and recent readings offer hope that inflation is cooling after progress on that front stalled in the first quarter، a trend that will likely need to be sustained for the Fed to feel comfortable cutting rates and American mortgage rates، says Doug Duncan، senior vice president and chief economist at Fannie Mae، in a June 21 statement، noting that the labor market is showing signs of a gradual slowdown، with the unemployment rate creeping up to 4% in the June report.

The National Association of Realtors expects American mortgage rates will start to decline in the second half of the year، reaching 6.7% in the fourth quarter، according to its latest Quarterly U.S. Economic Forecast، but the timing of the first rate cut is uncertain and the longer-term outlook is for the Fed to cut interest rates six to eight rounds by the end of next year، while home prices will remain solid، and home sales will pick up، especially in regions with rising inventory.

American mortgage rates will fall to 6.6% by 4th q.

In its June Mortgage Finance Forecast، the American Mortgage Bankers Association predicts that American mortgage rates will fall from 7% in the second quarter of 2024 to 6.6% by the fourth quarter but the industry group expects rates will fall to 6% at the end of 2025 and will average 5.8% in 2026.

Fed officials have reiterated that they will still need to see several months of data indicating softening inflation before moving to an initial rate cut، and expected a first rate cut from the Fed in September of 2024 and two cuts this year.

Economists at Freddie Mac expect American mortgage rates to stay above 6.5% throughout the end of 2024، according to its June Economic، Housing and Mortgage Market Outlook، and anticipates one rate cut later this year، as long as the job market slows down enough to temper inflation.

By historical standards، US economy is in good shape

Sam Khater، Freddie Mac’s chief economist، in a June 27 statement، revealed that، by historical standards، the economy is in good shape، and he expected American mortgage rates to continue to come down over the summer months، bringing additional homebuyers back into the market.

In its latest U.S. Economic Outlook، the Economics Group of Wells Fargo Bank puts the 30-year conventional American mortgage rates at 7% in the second quarter of 2024، declining to 6.5% by the end of the year، while the average rate will dip below 6% in the fourth quarter of next year.

The Fed's one rate cut is expected this year

The Fed's latest projections materials released in June show that one rate cut is expected in 2024، down from the three rate cuts the central bank had expected earlier this year، however، the Fed's economic policy isn't set in stone and if the economy begins to show signs of heating up or cooling down، policymakers may adjust their path accordingly.

Good things may come to those who wait، but patience doesn't always pay off in the housing market، as two-thirds of homebuyers are waiting for American mortgage rates to fall this year before buying a home، according to a March U.S. News survey، however، 67% of 2024 buyers put off purchasing a home in 2023 because they were holding out for lower rates، which didn't come.

American mortgage rates reaching a new peak of 7.79% in late October

In fact، rates trended higher last year، reaching a new peak of 7.79% in late October، according to Freddie Mac، before plunging a full percentage point to around 6.6% by year-end، while in the first quarter of 2024، rates started rising amid unexpected economic strength، hovering around the 7% mark once again.

In the time that homebuyers have been holding out for lower rates، home prices have continued to rise that on a national basis، home prices increased 6.3% between April 2023 and April 2024، according to the S&P CoreLogic Case-Shiller Home Price Index and home prices are expected to stabilize this year، but buyers shouldn't expect them to come crashing down، at least not on a national level.

Home prices aren't likely to drop significantly

Although home prices aren't likely to drop significantly، it's still positive that they're not likely to keep rising at the double-digit pace seen in 2021 and 2022، while without over-the-top bidding wars to drive home values through the roof، buyers can expect more properties to choose from.

In conclusion، buyers may find less competition in the new home construction market and homeowners may be reluctant to sell and sacrifice their low mortgage rates، but homebuilders remain eager to close the deal، although new-construction homes are typically more expensive than resale homes، builders may be willing to offer other concessions like price reductions or temporary interest-rate buydowns.

-1120252475029447.jpg)