الأحد، 08 فبراير 2026

01:36 م

عاجل

«هيئة المجتمعات» تحدد 9 ضوابط لتنظيم استخدام البدروم بالمشروعات السكنية

قريبا.. طرح دواجن مجمدة بأسعار مخفضة قبل شهر رمضان

«التمامي جروب» تطلق شركة «أصيل للتطوير».. وتعلن عن أول مشروعاتها «داون تاون» بالمنصورة الجديدة

أسعار الفراخ اليوم الأحد 8 فبراير 2026.. استقرار الأسعار بالمزارع

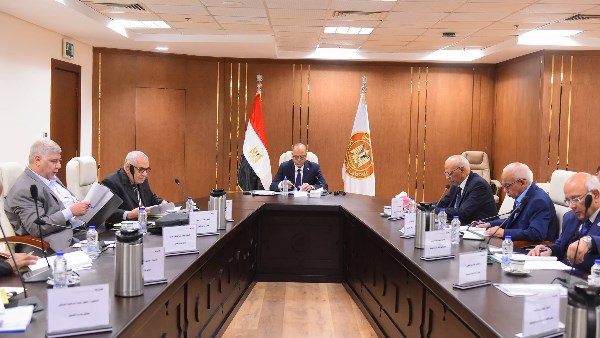

مدبولى يستعرض الموقف التنفيذى لمشروع التحول الرقمى لهيئة التأمينات الاجتماعية

اتفاق ثلاثي بين التموين والزراعة وجهاز مستقبل مصر لاستيراد دواجن مجمدة وطرحها قبل رمضان بأسعار مخفضة