ECB assumes a 45% slump for property values

European banks have been told to assume that real-estate assets most exposed to flood risk could lose almost half their value, as the sector’s resilience to climate change is stress-tested over the coming months.

The European Central Bank is factoring in a 45% slump over a single year for property values in areas that are likely to experience bad flooding, Fernando de la Mora, a managing director at Alvarez & Marsal, told Bloomberg ahead of the expected publication of the ECB’s scenarios later this week. That would leave German and Dutch banks among the most exposed.

An ECB spokeswoman declined to comment on the details of the stress test.

Europe, which was left in shock last year after floods devastated parts of western Germany and Belgium, is pushing banks to brace for potential losses as global warming and its political fallout send tremors through the wider economy. The ECB review is one of the most detailed of its kind to date, and examines everything from the impact of higher carbon prices to the implications of greater home energy efficiency for the mortgage market.

“What’s more concerning are the physical risks,” said de la Mora, who’s working with lenders to guide them through requirements laid out in the stress tests.

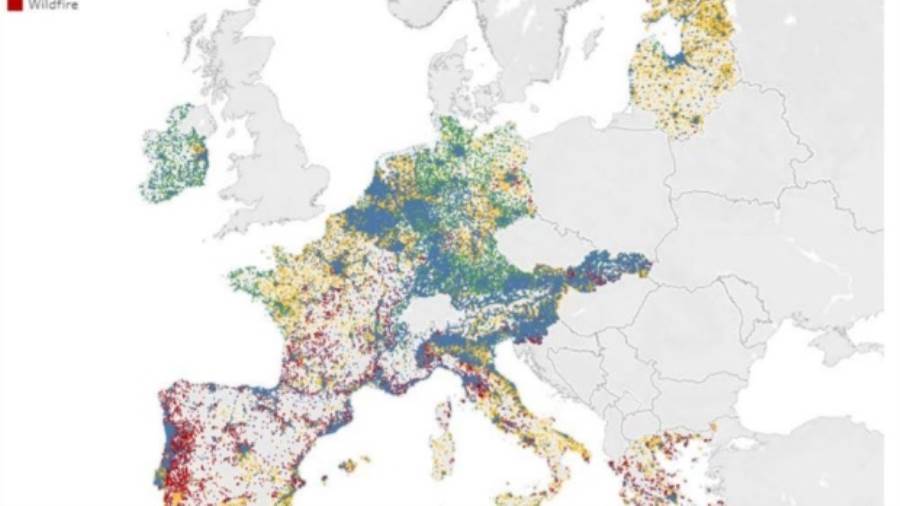

An ECB review last year found that 22% of euro-area bank exposures face high physical risk, more than half of which are related to wildfires, with floods making up the bulk of the remainder. The review by the central bank in September found that Austria, the Netherlands, Germany and France are more exposed to flooding, while wildfires pose a bigger threat in Italy and Spain.

For real estate assets facing a low risk of flooding, the ECB assumes a 5% drop in value, according to de la Mora. The central bank’s drought scenario is “more manageable” and entails an economic hit from lower productivity, he said. “Only southern European countries suffer larger GDP shocks in sectors tied to climate such as agriculture,” he said.

Part of the ECB’s stress test will try to find out how banks fare depending on whether governments act on commitments to fight climate change or not.

“The value of the long-term scenarios isn’t the precise number of provisions that banks will have to build, but the differential between those outcomes,” said de la Mora.

Take mining, an industry closely associated with global warming. Firms in the sector would see their credit spreads increase by 42 basis points by 2050 assuming there is an orderly transition to a low-carbon world, but by almost 350 basis points by 2030 under the disorderly scenario, said de la Mora. “The shock there is really in the short-term,” he said.

The long-term scenarios are also comparatively benign, considering they each factor in growth over the period. The European economy is projected to expand by 55% through 2050 if there is an orderly transition and 45% in a “hot house world” in which governments fail to act, said de la Mora.

“It’s somewhat surprising that the ECB is expecting all industries to manage the transition successfully,” said de la Mora. “The real estate shocks are quite mild as well, even if there’s a temporary decline for buildings with high emissions labels, they all end up at higher values in the end.”

The test runs from March to July with aggregate results due to be published in the third quarter. The ECB has faulted the industry for not having sufficient data on their climate risks and has called the test a “learning exercise.”

While the central bank plans to eventually ask lenders to treat climate change as they would other risks, the ECB has said that this year’s test won’t have a direct impact on banks’ capital requirements.

“The decisive factor will be what consequences the supervisor draws from the data obtained -- this is where a realistic, down-to-earth approach is called for,” said Georg Baur, a management board member at the Association of German Public Sector Banks. “As there are many imponderables associated with the test, it shouldn’t serve as a basis for imposing excessive burdens on the sector.”

-1120252475029447.jpg)