Climate Finance Kicks off Thematic Days Agenda at COP27

Opening Session addresses “Climate Finance in a Polycrisis Era”

Program of 26 events spotlights implementation, and just and equitable transition in Africa

Finance Ministers reflect on commitment to climate action and financing for loss and damage

Launch of COP27 Presidency Reducing the Cost of Sustainable Borrowing initiative

The pressing issue of climate finance kicked off COP27’s Thematic Days Agenda by reiterating it as a cornerstone for implementing climate action to save lives and livelihoods around the world.

In the first of 11 themed days at COP27, Finance Day addressed several aspects of the climate finance ecosystem, including innovative and blended finance and financial instruments, tools and policies that have the potential to enhance access, scale up finance and contribute to the transition envisaged and needed, including those related to debt for environment swaps.

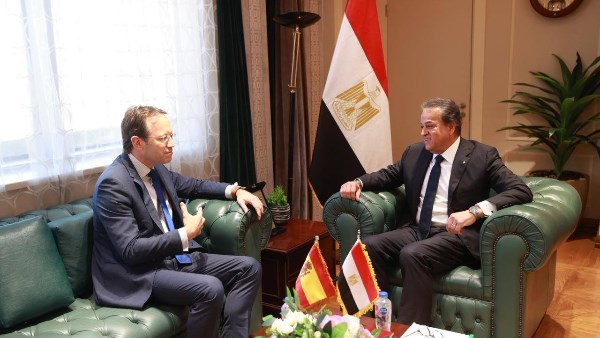

“Financing underpins the development of an energy transition pathway for Africa, but the unsustainable levels of public debt countries are managing acts as a block on advancing necessary climate initiatives,” said COP27 President H.E. Sameh Shoukry.

Finance Day featured a robust program of 26 events including a Ministerial roundtable and saw the launch of the Reducing the Cost of Sustainable Borrowing initiative.

It is estimated that the world will require between $4 trillion and $7 trillion per year, to shift towards sustainable development and meet agreed Paris Agreement targets, and today’s events enabled further cooperation to help close that gap. The sessions aimed to bring together all stakeholders involved in the climate agenda - from the public and private sectors to philanthropic entities, Multilateral Development Banks (MDBs) and the UN bodies, with the view to crafting an inclusive and just financing roadmap that supports the global South in implementing their adaptation and mitigation plans and renewing the commitment of developed nations to provide the necessary funding to “Leave No One Behind”.

At the opening ceremony, Egyptian Prime Minister H.E. Dr. Mostafa Madbouly, spoke to the significance of Finance Day, featuring an intensive program that included the discussion of topics that encourage the finance sector to assist the transformation to a sustainable economy and expressed hope that the conversations would be translated into serious commitments for finance adaptation. During the panel discussion, Climate Finance in a Polycrisis Era, key themes including innovative finance, financing just transition, sovereign debt for sustainability and climate change, and the role of the private sector in mobilizing resources were addressed. Private finance was highlighted as essential to deliver trillions of dollars needed to limit global warming to 1.5 degrees and ambition, action and accountability identified as critical to unlocking finance.

Access to low-cost finance was further addressed, with pragmatic solutions, deals, commitments, and pledges to reduce the cost of green loans. Discussions also involved adaptation plans and increasing the bankability and attractiveness to investors of adaptability projects.

During the day, several panels took place including:

Mobilizing Finance for Climate Action, wherein the key takeaway was a call for the doubling of finance compared to 2019 levels in 2025 by making the commitment for developed countries to step up financing so that developing countries to be reassured that no one will be left behind.

Reducing Cost of Green Borrowing, which showcased solutions and pledges needed to reduce the cost of green loans.

High-Level Dialogue CIF Force of Nature: Closing the Finance Gap for Nature-Based Solutions that discussed sustainable agriculture and forest management, including measures such as agroforestry that could deliver over $2 trillion annually in economic benefits, generate millions of jobs in developing countries and improve food security.

Special Role of MDBs/Commercial Banks/Philanthropies in Climate Finance, which reaffirmed that multi-lateral development banks, in spite of institutional challenges, are by far the most effective intermediaries in mobilizing and allocating resources that will benefit the poorest countries.

The sessions provided a chance for Finance Ministers from the parties to reassert their commitments to climate action, along with a call to acknowledge and commit finance for loss and damage. The day concluded with COP27 facilitating a meeting of the heads of the African sovereign wealth funds, helping to mobilise investments and public private partnerships for increasing climate action.

-1120252475029447.jpg)