China’s Country Garden Crisis Poses New Risk، similar to Evergrande،to Real Estate

China’s Country Garden Holdings Co. developer، China’s last real estate giant to avoid default، has spooked investors after missing key debt payments، rekindling memories of China Evergrande crisis، and its financial troubles are a warning sign for the Chinese gross domestic product، to become another Chinese property developer which teeters and raises worries about the economy as it has less than 30 days to avoid a default on its bonds، the latest signal of the government's struggle to end the nation's Real Estate sector slump as the economy slows.

Country Garden Holdings Co.، which had total liabilities of 1.4 trillion yuan ($194 billion) at the end of last year، said it had underestimated the market downturn and is facing the biggest challenge since it was established in 1992 and it expects to post a net loss of up to 55 billion yuan for the first half of 2023 compared with earnings of about 1.91 billion yuan a year earlier.

Country Garden crisis similar to Evergrande default

At almost $200bn now، Country Garden’s Holdings Co. liabilities are comparable with the $340bn held by Evergrande، whose collapse in 2021 triggered a series of other defaults. But Country Garden’s status as a top developer، until recently deemed safer than many of its highly levered peers، means any eventual default has deep ramifications but Country Garden’s woes show how deeply entrenched a two-year property crisis has become in China، casting doubt on the viability of the private developers that for decades drove the country’s urbanisation and economic growth.

The New York Times reported that Country Garden Holdings Co. developer’s liquidity crunch is adding to concerns about the potential drag the industry will have on growth in the world’s second-largest economy، sending a Bloomberg index of the country’s junk dollar bonds last Thursday to the lowest level since last year.

Country Garden tries to pay the interest payments in the coming weeks

China’s Country Garden Holdings Co. developper on its bonds in the coming weeks، as it has bond payments due every month for the rest of the year، according to Moody’s، and some $2.4 billion of bonds owed to investors in China and $2 billion of bonds owed to foreign investors by the end of 2024.

China’s Country Garden Holdings Co.، one of China's largest developers is wobbling and has less than 30 days to avoid a default on its bonds to remind the financial markets of China Evergrande، that Chinese real estate behemoth whose mountain of debt sent global markets spiraling in 2021 that its collapse signaled the start of a crisis for China’s housing market، where sales of apartments ground to a halt and developers big and small found themselves unable to pay their bills.

Country Garden Financial troubles، flashing warning about property slump

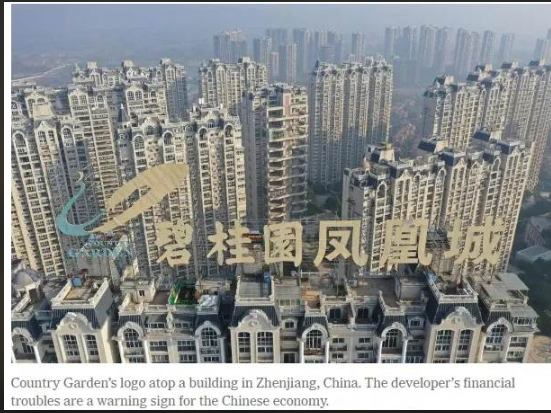

Financial troubles at Country Garden Holdings Co.، in Zhenjiang، China، another real estate giant، are raising fresh concerns as they are also a flashing warning sign about China’s economy as well as the latest signal of the government's struggle to end the nation's property slump as the economy slows.

China’s Country Garden Holdings Co.، the country’s biggest developer by sales، has been pummeled in the markets twice in the past week. Investors are panicked by two events: On Aug. 1، the company scrapped a plan to inject cash into the business، something it needs. This week، it missed two interest payments on bonds. The bond payments، which are owed in U.S. dollars، are relatively small in value، but by missing them، the company put itself at risk of default.

Country Garden’s market value has been more than halved

China’s Country Garden Holdings Co.’s market value has been more than halved since the start of the year and traders were swapping some of its bonds for as little as 10 cents on the dollar last week، a sign of doubt that they expected to be paid back in full.

Investors are alarmed because China’s Country Garden Holdings Co. had largely benefited from measures to bolster the real estate market last year that included more financial support، that for some time، the Chinese authorities designated it as a model developer، so that the company became more palatable، when many other Chinese developers were in trouble.

Country Garden distress was unthinkable a year ago

But recent events have led China’s Country Garden Holdings Co. to a point of distress that was unthinkable a year ago، when it was making nearly $50 billion in sales as the worry now is that even as Beijing has pledged more support to the real estate market، the measures may not be enough.

Country Garden Holdings Co.’s financial faces a crisis now and much of the squeeze on its position has come from a drop in sales of its apartments since fewer people in China are interested in buying homes and the company issued a profit warning in July، saying it most likely had lost money in the first half of this year، in part because of a downward trend of real estate sales.

Country Garden is facing a cash crisis

Country Garden Holdings Co. is facing also a cash crisis when the real estate sector is in the dumps and China’s leaders are trying to rev it up although there had been some optimism in July when top government decision makers pledged policies to help but much of the initiative is in the country’s biggest cities، like Shenzhen and Shanghai، and the measures are unlikely to benefit Country Garden، which operates more in small cities.

The two bond payments that Country Garden Holdings Co. missed last week do not amount to a lot of money for the company، which also has a 30-day grace period، but a default could scare those who have lent it money in the past.

Country Garden potential default

Country Garden Holdings Co.’s potential default is another ominous sign for China’s economic outlook as its leaders look to reboot the economy after three years of stringent Covid19 prevention measures that suppressed economic activity.

Home sales in China were down in the first half of the year، a decline that accelerated last month and one in five young Chinese is out of work، in addition، people are not spending money، leading companies to slash prices and in smaller cities، where Country Garden Holdings Co. continues to build its sprawling residential complexes، authorities are facing an oversupply of housing and a steady decline of population.

The nervous investors will make Country Garden financial pressures more pronounced

The worst is that nervous investors will make Country Garden Holdings Co.’s financial pressures more pronounced as the company has fared worse than the broader market and developers that concentrate in bigger cities، where the real estate slowdown has not been as acute but Country Garden’s sales under contract plunged nearly a third over the first six months of the year.

Investors fear contagion from Country Garden Holdings Co. is deepening troubles and shellshocked creditors who have continued to lend to developers might think twice before giving them more money and Country Garden latest announcement just confirmed investors’ worst fears about the dire state of China’s ailing property market، as well as home buyers may stay away from a company on the precipice of collapse since they’ve seen this movie before.

Regulators seeking since late last year to revive demand in the real estate sector

Regulators across China’s government have been seeking since late last year to revive demand in the real estate sector، which makes up about a fifth of China’s gross domestic product but measures such as easing mortgage rates on first-home purchases have so far failed to stem the crisis، with home sales tumbling the most in a year in July and the downturn has left the property sector caught in a vicious cycle، after an earlier government campaign aimed at getting developers to deleverage caused housing purchases to slump and to crimp the cash flow of builders، leading to a record amount of defaults.

The latest crisis came after bondholders of two dollar notes of $22.5mn issued by Country Garden Holdings Co.، helmed by one of China’s richest women Yang Huiyan، formerly Asia’s richest woman، failed to receive coupon payments due Aug. 7، and the renewed turmoil comes just as signs emerge that economic demand is weakening as hopes of a rapid recovery following the rollback of pandemic measures fizzle out، sending shockwaves through the country’s struggling real estate industry.

Country Garden has 31 years expertise in China Real Estate

Country Garden Holdings Co. was founded in 1992، when nationwide reforms paved the way for private sector businesses to drive urbanisation in China and it eventually grew to become the country’s biggest developer by sales، which exceeded half a trillion renminbi in each year from 2018 to 2021، but after Evergrande and other developers defaulted in 2021، Country Garden was seen as stable، but there were concerns over its exposure to China’s third- and fourth-tier cities، which accounted for %60 of its sales last year.

Like many developers in China، Country Garden heavily relied on customers “prepaying” before their flat was completed. Sales act as a crucial source of funding، with the proceeds then invested in new projects، but in July this year، its sales slumped further to just %40 of their level last year and they have dropped for four consecutive months، exacerbating a cash crunch at the company.

-1120252475029447.jpg)