Future outlook of China’s worst-selling green car companies to become even bleaker

China Evergrande New Energy Vehicle Group Ltd.، the green car maker that's part of the defaulted property developer and which in early 2019 bragged it would one day take on Elon Musk's Tesla Inc.، has lost a staggering $10.8 million for each electric battery-powered car sold in its short existence، or $14.4 billion on the around 1،300 of its vehicles registered، as Hyperdrive calculations indicated based on the company’s financial filings and car insurance industry data.

Bloomberg News Agency reported that China Evergrande New Energy Vehicle Group Ltd.، the green car or electric vehicle، EV، maker، was dealt a setback by Dubai-based NWTN، a company that had agreed just two months earlier to invest $500 million.

NWTN suspended support payments to China Evergrande New Energy Vehicle Group Ltd

Dubai-based NWTN suspended، last week، support payments to the electric vehicle، EV، or green car maker، China Evergrande New Energy Vehicle Group Ltd.، which is affiliated with one of China’s most troubled property developers.

Privately held WM Motor meanwhile، which last week said a Shanghai court has accepted a pre-restructuring application as it grapples with financial difficulties، strives to rescue business as pressures mount and has seen sales collapse by more than 90% despite a slew of paycuts and staff layoffs to reduce expenses.

Evergrande NEV and WM Motor attracted the backing of Baidu and Tencent

Like Evergrande New Energy Vehicle، NEV، which at one point had a market value more than Ford Motor Co.، it’s a significant come down for green car maker WM Motor which was established in 2018، showed so much promise، in investors’ eyes at least، that it attracted the backing of Baidu Inc. and Tencent Holdings Ltd.

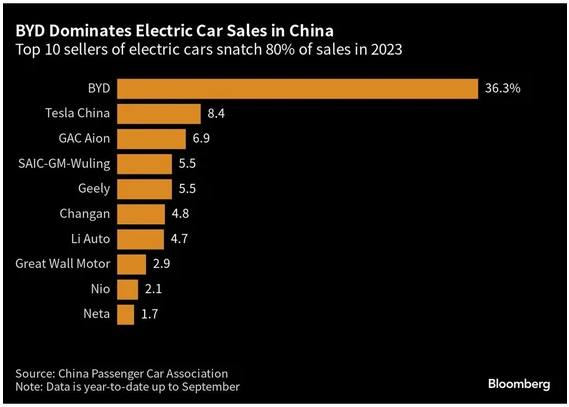

As the pair tread water waiting for sales to materialize، signs of further consolidation in China’s too-crowded EV sector are looming large، while at the same time، dominant players like Tesla and BYD Co. are getting even stronger and the top 10 green car makers are on track to account for around 80% of all EV sales this year.

Main problems of green car companies

Jing Yang، the director of China Corporate Research at Fitch Ratings stated that when looking at these green car،EV، companies with minimal sales from a credit perspective، their main problems are a very high execution risk in strategy، sustained negative free cashflow and liquidity risk.

For those green car automakers، it’s very hard to access the bond markets as their refinancing risk becomes elevated if equity investors and banks walk away، while outside of WM Motor and Evergrande، over a dozen electric car، EV، brands now face dwindling sales.

Around 91 active electric car manufacturers are registering sales of less than 500 cars a quarter

Data from China Automotive Technology and Research Center show that while there are around 91 active electric car manufacturers، almost one-third of them are registering sales of less than 500 cars a quarter، while Tesla، by way of comparison، shipped about 74 thousand green cars last month alone from its factory in Shanghai.

Brands of green car companies such as Aiways، Zotye and Haima، for example، at their peak used to be able to move hundreds or even thousands of new-energy cars a quarter، but for the second quarter of 2023، their new registrations stood at no more than 20 vehicles، however، select investors are continuing to back the most promising upstarts.

The sector of green car moves from overcrowed to moderately concentrated

The sector of green car is hovering around a threshold that would mark a transition from overcrowed to moderately concentrated، according to the Herfindahl-Hirschman Index، a metric used by academics and regulators to evaluate competition and measure market concentration. Xpeng Inc. in July scored a $700 million investment from Volkswagen AG under which the German automaker will hold a 4.99% stake in the Chinese green car company and have an observer board seat.

Nio Inc.، which has yet to make profit but aims to double sales to 250 thousand green car or EVs this year، has meanwhile sold a 7% stake to an entity controlled by Abu Dhabi for about $740 million and is considering raising another $3 billion in the Middle East and locally.

Other companies trying to muscle into the green car market

There are still companies trying to muscle into the green car، EV، market، like Xiaomi Corp، the Chinese smartphone maker which is now holding talks with established automakers on potential production partnerships as it waits for Beijing to approve a license that would give it the right to manufacture electric vehicles، EVs، itself.

But with sales growth of new-energy vehicles in China slowing and exports more than doubling last month as domestic demand slumps، it’s hard to see how stragglers like WM Motor and Evergrande NEV can stick around for the long term as their demise، if it eventuates، should send a chill through many other hangers on too.

-1120252475029447.jpg)