Meta shares rose20%in single day with market value now of $1.22 trillion

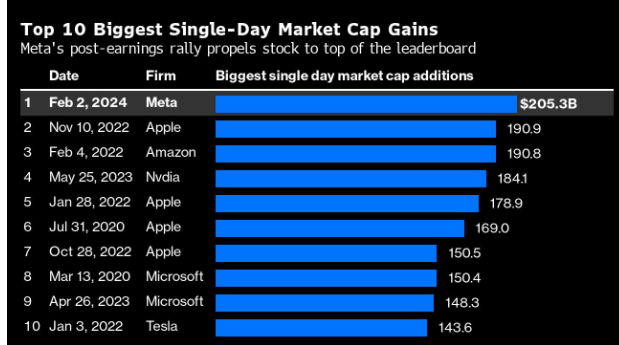

Meta، formerly Facebook، shares surged 20% yesterday to at an all-time high of $475، after big earnings beat، buyback and dividend plans، adding $197 billion to the Facebook، Instagram and WhatsApp parent company’s valuation، which is the biggest in Stock Market history to become now $1.22 trillion، to be the most market value any US company has ever gained in a single day، eclipsing the $190 billion gains made by Apple Inc. and Amazon.com Inc. in 2022.

Meta shares earns $197Billion in a single day a record in Stock-Market History

Meta shares rose 20% Friday to close at an all-time high of $475 per share and this gain added $197 billion to its market capitalization، the biggest single-session market value addition in American history، but Meta Stock also holds record for the biggest wipeout in history when the drop in market value over a single day of trading was on Feb. 3، 2022، when Meta Platforms Inc. (META) operating as Facebook، lost $232 billion in market value to surpasse the previous largest single-day loss held by Apple Inc. (AAPL) only 17 months earlier.

Meta Platforms Inc.، formerly Facebook، just became Wall Street’s top comeback kid as the website that Mark Zuckerberg started in his dorm room turns، about 20 years ago، and it’s already received the biggest birthday present in market history as the company on Thursday dazzled shareholders with yet another impressive quarterly earnings report.

Meta cut back costs and shored up billions in profits

Meta Platforms Inc.، formerly Facebook، the social media giant focuses on cutting back costs and shoring up billions in profits، howeve، it was only a couple of years back the Facebook owner suffered the single biggest market value destruction in stock-market history، but the company has come a long way since then.

Brian Nowak، an analyst at Morgan Stanley، wrote in a note Friday، that Meta Platforms Inc.، formerly Facebook، achieved solid execution، faster growth، and increased capital structure efficiency to improve its outlook as Meta’s AI pipeline for both users and advertisers is robust، with more tools set to launch and scale throughout the day.

Meta reduced headcount by % 22 in 2023

Meta Platforms Inc.، formerly Facebook، which reduced headcount by % 22 in 2023، unveiled plans for a $50 billion stock buyback، and announced its first quarterly dividend on Thursday، a sign to investors that it has money to spare and a reason for them to stick around.

Meta Platforms Inc.، formerly Facebook، is making big cost cuts، but it continues to spend aggressively on artificial intelligence advancements، namely in generative and announced that it had authorized another $50 billion in share buybacks in a massive repurchase، but it isn’t the largest in the land of big tech and it’s not even the first time Meta has planned $50 billion in buybacks.

Meta released an absolute banger of a Q4 earnings report

Meta Platforms Inc.، formerly Facebook، released an absolute banger of a Q4 earnings report on Thursday، showing that it tripled its profits compared to the same period the year before and recorded its fastest rate of revenue growth since 2021، which indicates a comeback for online advertising.

The company also announced that it will begin paying out 50-cents-per-share quarterly dividends for the first time and investors say these are good signs for the company’s outlook and cash reserves، marking its transition into a mature business، while the stock rally is going to pay for a lot of hoodies، as Mark Zuckerberg the owner of about 350 million shares of Meta Platforms Inc.، formerly Facebook، added $28.1 billion to his net worth yesterday and stands to gain nearly $700 million each year from the dividends.

-1120252475029447.jpg)