Mohamed El-Erian:US housing market crushed by Federal Reserve's aggressive interest rate hiking

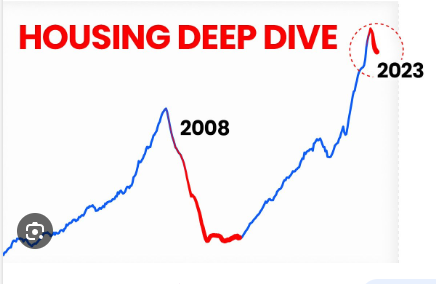

Mohamed El-Erian، the Allianz chief economic advisor، confirmed that the US housing market may be broken، and the Federal Reserve's aggressive interest rate hiking cycle over the past year could be to blame and may have destroyed the real estate market by crushing both supply and demand as well as the interest rate hikes have helped drive up mortgage rates that the average rate on the 30-year fixed mortgage notched a fresh 23-year-high last week، clocking in at 7.48%، weighing on the market.

Top economist Mohamed El-Erian، the Allianz chief economic advisor، said in an interview with CNBC that there's a real issue as to whether we've broken the housing market due to high mortgage rates which have frozen the housing market over the past year by crimping both supply and demand.

Existing homeowners are discouraged from putting their properties up for sale

Dr. Mohamed El-Erian indicated that many prospective buyers are priced out of the market due to higher costs of borrowing، meanwhile، existing homeowners are discouraged from putting their properties up for sale، as many are looking to cling onto the low interest rates at which they financed their homes years ago، so this has kept prices elevated even as demand slips.

Top economist Mohamed El-Erian assured that the result is a housing market in a state of limbo، with affordability unlikely to improve unless mortgage rates dial back more significantly as when you go from record-low mortgage rates to levels that we haven't seen for almost 20 years، you've destroyed both demand and supply.

The irony is that supply has come down and demand has come down as well

Dr.Mohamed El-Erian، the Allianz chief economic advisor، explained that the irony is that supply has come down and demand has come down as well، that is the way you destroy the housing market، therefore we've got to be really careful because the housing market is central to the economy.

Top economist Mohamed El-Erian، the Allianz chief economic advisor، stated that mortgage rates have been pushed higher by the Fed's aggressive interest rate hikes over the past year، with central bankers raising rates 525 basis-points to tame inflation in the economy that short-term rates are now the highest they've been since 2001، which economists have warned could push the economy into a recession.

Dr.Mohamed El-Erian، a loud critic of the Fed's monetary tightening

Dr.Mohamed El-Erian، for his part، has been a loud critic of the Fed's monetary tightening over the past year as he said previously that the US faced an "uncomfortably high" probability of a downturn، though the central bank couldn't afford to cut interest rates prematurely and that could risk inflation expectations spiraling out of control، slamming the economy with a far more serious stagflation problem as prices accelerated 3.2% in July، down significantly from the peak of 9.1% hit last summer.

He thinks that when unleashing the Bolder within، it is better as at Bold Group، we're on the hunt for those who dare to dream and push boundaries and sit where creative minds have sat before، they become part of our legacy.

Mohamed El-Erian: inflation could rebound over the short-term

However، Top economist Mohamed El-Erian warned that inflation could rebound over the short-term، thanks to persistent services inflation and wage inflation and that could result in the Fed's inflation target quietly drifting to 3% as central banks are forced to tolerate higher-than-ideal prices in the economy.

Mohamed Aly El-Erian is an Egyptian-American economist and businessman، President of Queens' College، Cambridge، and chief economic adviser at Allianz، the corporate parent of PIMCO where he was CEO and co-chief investment officer since 2014، Chair of Gramercy Fund Management، a columnist for Bloomberg View، and a contributing editor at the Financial Times، as well as serves on two corporate boards and several advisory committees and non-profit boards.

Mohamed Aly El-Erian spent 15 years at the International Monetary Fund in Washington

Dr. El-Erian was a managing director at Solomon Smith Barney/Citigroup in London and before that، he spent 15 years at the International Monetary Fund in Washington، D.C. where he served as Deputy Director before moving to the private sector and also served as Chair of President Obama’s Global Development Council from December 2012 to January 2017.

He has published widely on international economic and finance topics with his 2008 book، “When Markets Collide،” was a New York Times and Wall Street Journal bestseller، won the Financial Times/Goldman Sachs Business Book of the Year and was named a book of the year by The Economist Magazine and one of the best business books of all time by the Independent (UK) as well as was named to Foreign Policy’s list of “Top 100 Global Thinkers” for four years in a row.

-1120252475029447.jpg)