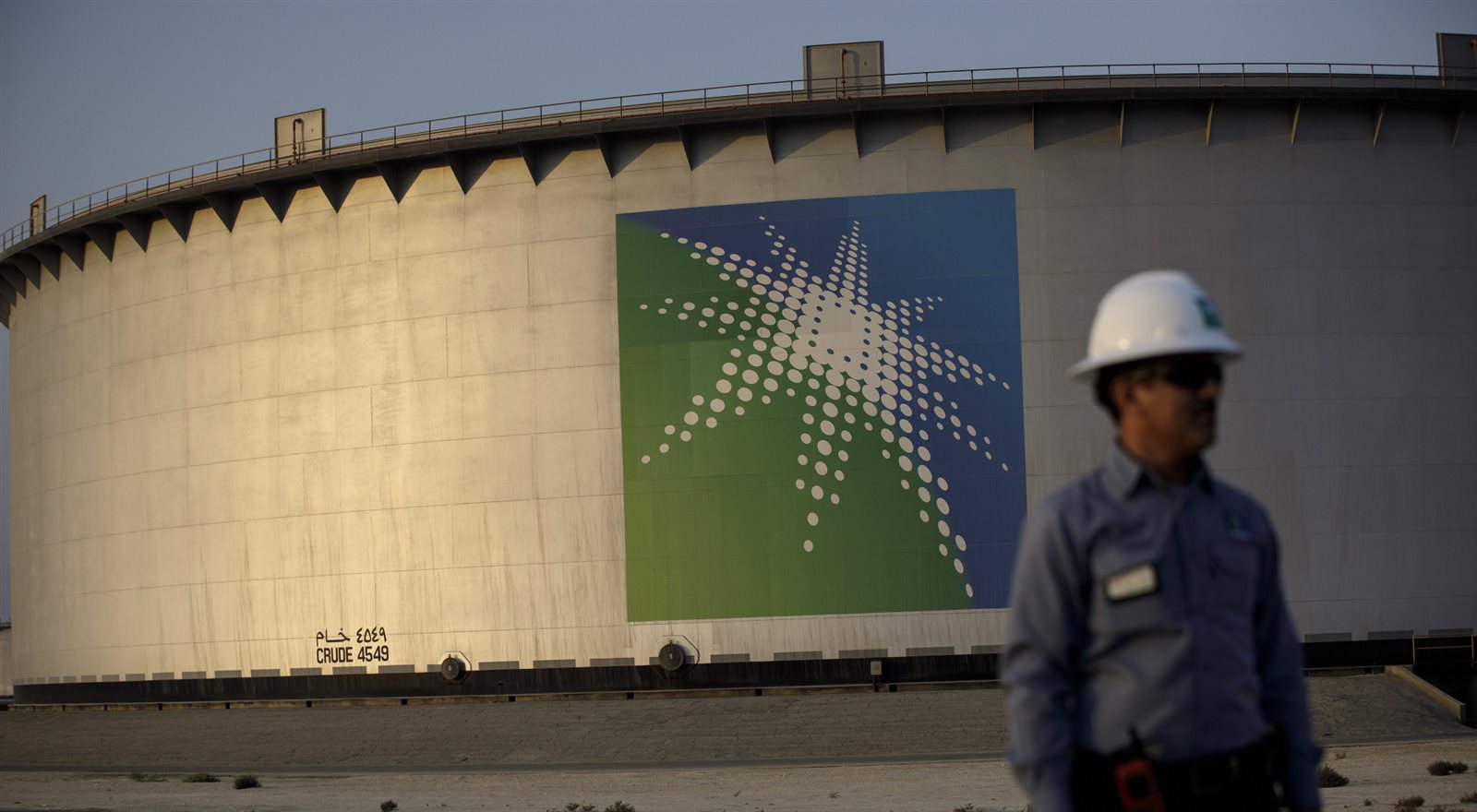

Aramco is bringing its financial heft to LNG

Aramco to Enter Global LNG With Stake in MidOcean Energy

Saudi Aramco agreed to buy a stake in MidOcean Energy for $500 million، its first investment in liquefied natural gas as the company seeks to diversify beyond its core oil business.

Aramco is bringing its financial heft to LNG at a time when global demand for the fuel has surged، particularly in Europe which is replacing reduced pipeline supplies from Russia. The deal underscores a push to get Saudi companies to invest more internationally alongside efforts to branch out from oil under Crown Prince Mohammed bin Salman’s Vision 2030 development plan.

Part of a consortium

MidOcean Energy is in the process of acquiring interests in four Australian LNG projects، Aramco said in a statement. The company is managed by EIG Global Energy Partners، which was part of a consortium that acquired a 49% stake in Aramco Oil Pipelines Co. in 2021.

Aramco has been trying to set up LNG operations for a few years after hiring traders in Singapore. It had also negotiated with Russia’s Novatek PJSC as a potential partner for one of its liquefaction projects five years ago.

Saudi Arabia borders Qatar، a much smaller state which has outsized global influence in part thanks to its position as one of the world’s top LNG exporters. Profits from trading the liquefied fuel have surged in the past year following price increases and soaring European demand، luring new entrants.

“This is an important step in Aramco’s strategy to become a leading global LNG player،” Nasir K. Al-Naimi، upstream president، said in the statement. “We see significant opportunities in this market، which is positioned for structural، long-term growth.”

The deal will give Aramco a minority stake in MidOcean، with the option to increase its shareholding in the future.

MidOcean Energy last year said it would buy Tokyo Gas Co.’s investments in four LNG export plants in Australia. MidOcean is also part of a Brookfield Asset Management Inc. consortium to buy Australian utility Origin Energy Ltd.

Developing Jafurah gas field

While oil is still a vital part of the Saudi economy، gas is becoming a major part of its investment plans. Aramco is spending $110 billion developing the unconventional Jafurah gas field that will help double output by 2030 and make the kingdom a gas exporter for the first time.

Initially، the company planned to focus on using gas from the project to produce so-called blue hydrogen، which can be exported as a clean energy source. However، after struggling to secure long-term sales contracts for the fuel، it’s begun to weigh exports of LNG instead.

Investing in refineries

Aramco’s chief executive officer، Amin Nasser، said the oil producer had started looking for investments in global LNG suppliers in May، confirming an earlier Bloomberg report.

Aramco has also been stepping into other energy businesses. While crude oil production remains its main operation، it has invested in refineries and petrochemical projects in China and in fuel retailing in South America.

As part of a plan to reduce emissions، the company is investing in renewable energy sources including wind، solar and hydrogen production، and capturing carbon directly from the atmosphere، at the same time as boosting output of crude. Saudi Arabia is also considering building nuclear power projects.

-1120252475029447.jpg)