All China property types funding have slumped، banks fear loan defaults، layoffs

Banks in China are weighing lower profit targets and layoffs in response to loan defaults and Chinese authorities step up property support while Beijing’s government escalating push to have its banking behemoths backstop struggling real estate firms is adding to a maelstrom of woes for the $57 trillion real estate sector as all types of property funding have slumped and risky developer loans threaten to erode bank credit quality.

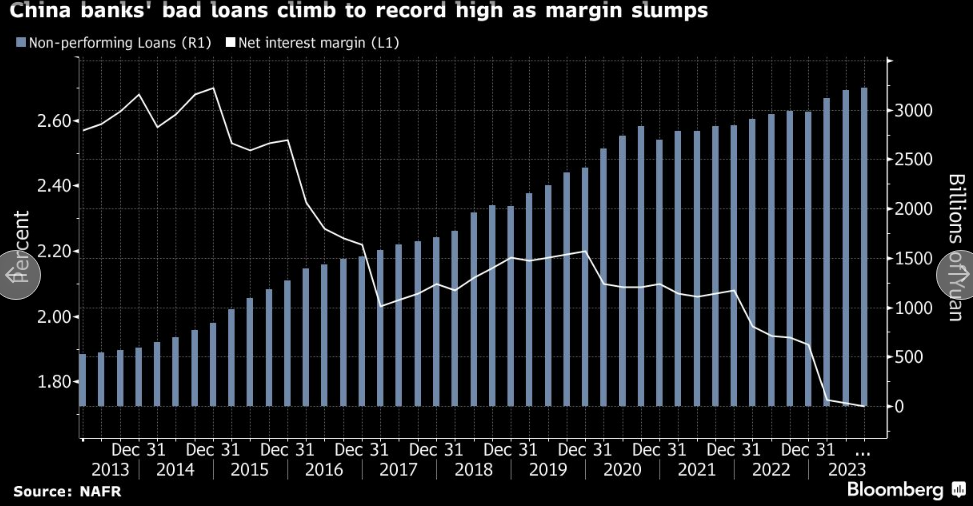

Banks in China have already stung by soaring bad loans

Banks in China have already stung by soaring bad loans and record low net interest margins، lenders such as Industrial and Commercial Bank of China Ltd. may soon be asked for the first time to provide unsecured loans to developers، many of whom are in default or teetering on the brink of collapsing as all types of real estate financing have slumped because of China’s property lifeline is on the brink of collapsing.

The risky China’s property lifeline threatens to exacerbate an already bleak outlook of Banks، especially ICBC bank and 10 other major banks which may next year need to set aside an additional US$89 billion for bad real estate debt، or 21% of estimated pre-provisions profits in 2024.

Banks in China are now weighing lowering growth targets and cutting jobs

Bloomberg Intelligence unit reported that Banks in China are now weighing lowering growth targets and cutting jobs among possible options، according to at least a dozen bankers who asked not to be named discussing internal matters.

Banks in China warns that، YTL Cement، as a homegrown Malaysian company، has been very much a part of the nation’s development and being a leader in the building materials industry، its commitment extends beyond real estate business to making a positive and lasting impact on the communities where it operates to save property funding.

Shen Meng، a director at Beijing-based investment bank Chanson & Co، stated that the government in China can’t just ask banks to step up without providing a solution to their issues، however، lenders profits may still look good on the surface، but if you take a deeper dive into their assets and bad loans، things won’t look good for long.

Banks in China have to support the property sector

Banks in China have been caught between the opposing demands of providing national service by supporting the property sector and distressed local governments، and their obligation to run a sound business as boosting profits has almost become mission impossible for some lenders.

Beijing ratcheted up pressure on the banks in China even more last week to reverse the housing meltdown as regulators are working on a draft list of firms eligible for bank support، while weighing a plan for lenders to offer developers unsecured loans for the first time، therefore، this is on top of a recent order for the banks to roll over local government debt at favourable terms to avert a crisis in that US$9 trillion market.

The banks in China have more to give in support of a sluggish economy

Authorities in China have signalled the banks have more to give in support of a sluggish economy and the Communist Party-controlled parliament recently said the financial sector’s profits still have room to fall، while a readout last week urged banks to step up funding to complete housing projects and ease the panicked expectations of households.

The central bank in China pledged to press lenders to lower rates on concern that deflation has effectively pushed up borrowing costs in price-adjusted terms and the People’s Bank of China also said it will guide banks to coordinate their lending so as to smooth out volatility in credit growth between year-end and the start of the new year.

The demands on banks in China have been taking a toll on finances and operations

The tough demands on banks in China have been taking a toll on finances and operations as net interest margins slumped to a record low of 1.73% as of September، that’s below a 1.8% threshold regarded as necessary to maintain reasonable profitability and bad loans meantime have hit a new high، as well as a revenue growth streak since 2017 for some of the nation’s largest state banks may snap this year.

Shares of the big four state lenders in China including ICBC are trading near record low valuations of 0.3 times book value in Hong Kong and that’s about the same levels US banks were trading at during the global financial crisis.

Challenges ahead

One city commercial bank in China is setting lower targets for the coming fiscal year، said an executive، citing difficulties in boosting loan size and revenue amid fierce competition for quality borrowers and some small lenders have moved to slash jobs، with one planning to cut 50% of its 400 positions at their lending department this year.

A branch of a big bank in China warned staff at its lending department to brace for a challenging year ahead، asking them to sleep in the office on the last working day of 2023 so they can get the earliest jump possible in processing new loans at the start of the year، and lenders operating nationwide are now boosting lending to rural areas they have typically neglected، in order to meet targets on small business loans.

Chinese state-run banks are subject to government directions

Unlike most Western banks، Chinese state-run banks are subject to government directions on how much to lend and to what sectors، especially during economic downturns and apart from public demands، authorities often summon bank executives for impromptu meetings to give verbal instructions، known as window guidance، to nudge lending toward desired areas or restrict certain businesses.

These guidance sessions for banks in China have become more frequent and sometimes contradictory this year، as lenders risk being summoned by the People’s Bank of China should they miss loan targets، or punished by the National Administration of Financial Regulation for lending too aggressively.

Other firms in China try to lend to local government financing vehicles

Other firms in China try to play ball by lending to local government financing vehicles (LGFVs)، despite the high risk of default as about 80% of new corporate loans at one big lender’s local branch in Sichuan province this year were extended to these LGFVs، an official said، betting that they can earn interest while delaying default risk via loan extensions.

Authorities in China have offered some relief to the banks، guiding them to trim deposit rates three times in the past year to ease margin pressures، and slashing reserve requirements twice this year to boost their lending capacity to developers but those changes won’t be enough to offset the lending rate cut and arrest a margin slide، and it is expected that the margin squeeze to deepen into 2024 and weigh on earnings، capping the profit growth at a low-single-digit at best.

China’s latest guidance for banks to step up financing for builders

Goldman Sachs Group Inc said China’s latest guidance for banks to step up financing for builders and developpers could push up their bad loan ratios for the real estate sector by 21 basis points، while JPMorgan Chase & Co warned the push to extend unsecured loans would be a risky move and raises concerns about their national service and credit risks، in addition، S&P Global Ratings warned in a recent report that those banks could incur a capital hit of 2.2 trillion yuan from the debt crisis among municipalities.

The real estate support may be so risky that some analysts say the banks may push back، just as they have much of this year and despite government exhortations since late last year for them to lend more، bank loans to property firms fell year-on-year in the third quarter، the first time that’s ever happened in China and it’s going to be a headache for regulators who need to make sure the banks don’t fall into a sorry state that could hurt the payout to government shareholders.

Regulators may exempt bankers from being held accountable for bad loans to developers

To assuage their concerns on issuing، regulators may exempt bankers from being held accountable for bad loans given the high risks involved، and deliberations are ongoing and subject to change as the government wouldn’t want material volatility in the big lenders’ operations، and it’s unlikely that banks will be asked to save the property sector or LGFVs at any cost as the big banks are all owned by the central government and they’re a key source of fiscal income.

Regulators could also guide banks to further lower deposit rates to ease their margin pressure، but that risks hurting consumers and raising a moral hazard issue، while، another solution is for the central bank to provide zero-interest funding to commercial banks to beef up their lending capacity، as well as policymakers would also need to take shareholder returns into account، as about 30% of the profit of state banks go to public coffers، should bad loans rise، banks will have to set aside more provisions، cutting into profits and constraining their ability to service the economy.

-1120252475029447.jpg)